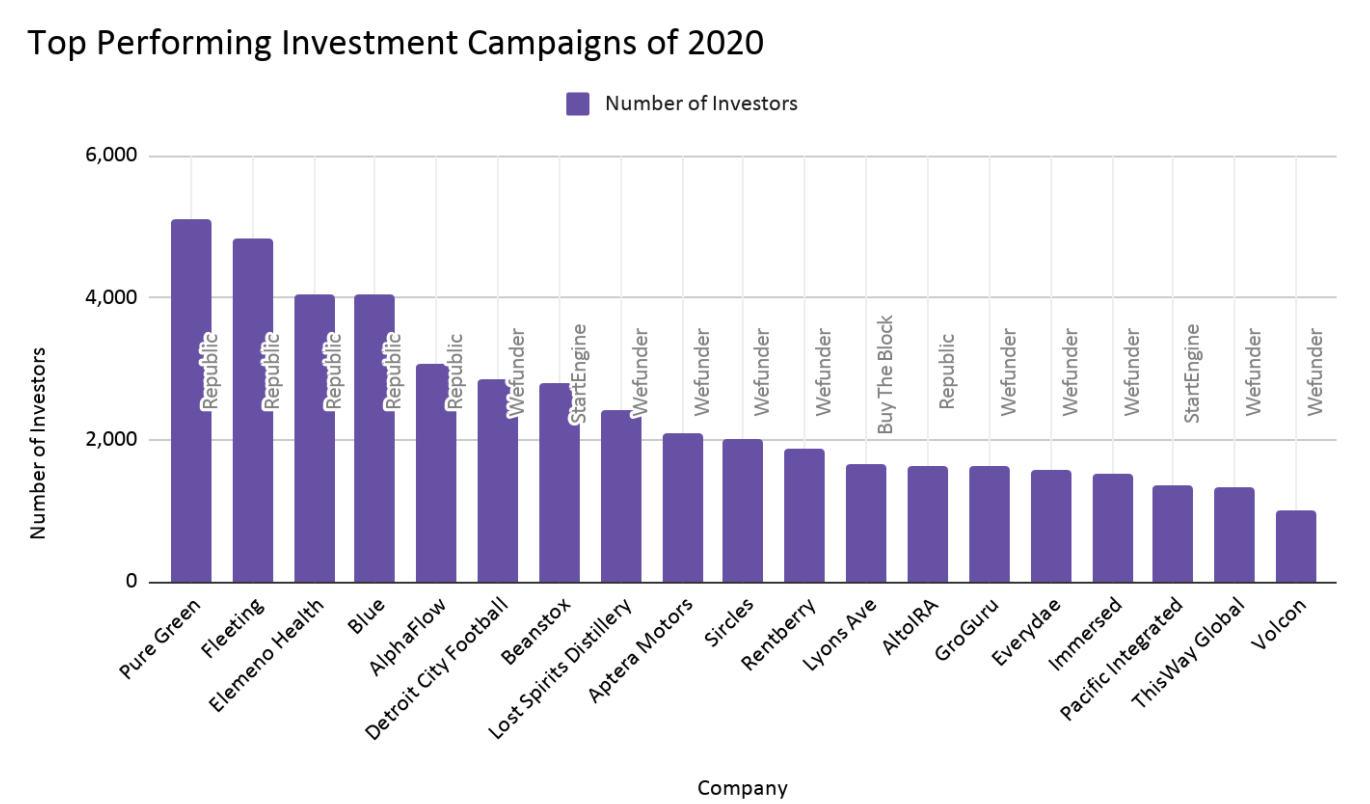

One of the most exciting things about equity crowdfunding is its inclusivity. And while we most often talk about that in terms of founders, it holds true for investors too. Before crowdfunding, everyday investors never had the chance to back the startups they wanted to see succeed. The ability to fund the future was provided only to the wealthiest investors — until 2016. In celebration of this democratization, this Chart of the Week takes a look at 2020’s Top Performing Campaigns in the online private markets. Each of these companies reached their max goal of $1.07 million, so we decided to examine how many investors helped them achieve that milestone.

At first glance, it becomes quickly apparent that raises on Republic were popular with numerous investors. The top five companies in terms of number of investors (remember all of these companies reach their max funding goal) all hailed from Republic. Republic’s max raises in 2020 averaged a staggering 3,786 investors — meaning the average each investor contributed was around $282.

Wefunder is on the other end of the spectrum, with many of their maxed out raises drawing in fewer investors. Wefunder’s raises had an average of 1,832 investors — meaning investors on Wefunder invested more than twice as much on average ($584) than investors on Republic. This data may indicate that investors on Wefunder invested with more conviction than those on Republic and thus invested larger amounts. Additionally, nearly half of the top performing raises in 2020 (9 of the 19) came from Wefunder. This stat, too, seems to show the conviction of investors on Wefunder.

Lastly, it seems the majority of the companies in our top performing list are quite easy to understand. Whether it’s the business model, the product or service proposition, or the go-to-market strategy, it makes sense that the simpler an investment, the easier it is for investors to understand — and thus feel confident investing in. With the new $5 million max limit for Regulation Crowdfunding campaigns, it will be interesting to revisit this data set next year and see what’s changed!