Expensify (EXFY)

Easy Money.

Overview

IPO Stage

Robinhood

Not Provided

IPO

Nasdaq

$23 - $25

$2B

J.P. Morgan, Citigroup, BofA Securities

0

2009

Business Services, Software, & Applications

Fintech

B2B

High

Low

Income Statement

|

Revenue |

$88,072,000 |

|

Operating Expenses |

|

|

Research/Technology & Development |

$6,728,000 |

|

Sales & Marketing |

$9,888,000 |

|

General & Administrative |

$33,372,000 |

|

Total Operating Expenses |

$49,988,000 |

|

Operating Income |

$5,670,000 |

|

Other Income, Net |

$0 |

|

Income (Loss) Before Provision For (Benefit From) Income Taxes |

$2,952,000 |

|

Provision For (Benefit From) Income Taxes |

$-4,662,000 |

| Net Income (Loss) |

$-1,710,000 |

|

Net Income (Loss) Attributable to Common Stockholders: |

|

|

Basic |

$-1,710,000.00 |

|

Diluted |

$-1,710,000.00 |

|

Net Income (Loss) Per Share Attributable to Common Stockholders: |

|

|

Basic |

$-0.06 |

|

Diluted |

$-0.06 |

|

Weighted-Average Shares of Common Stock Used For Pro Forma: |

|

|

Basic |

27,424,480 |

|

Diluted |

27,424,480 |

Balance Sheet - Assets

|

Current Assets |

|

|

Cash and Cash Equivalents |

$34,401,000 |

|

Accounts Receivable |

$10,024,000 |

|

Total Current Assets |

$63,664,000 |

|

Property and Equipment, Net |

$15,363,000 |

|

Goodwill |

$0 |

|

Intangible Assets, Net |

$0 |

|

Restricted Cash |

$0 |

|

Other Assets |

$833,000 |

| Total Assets |

$87,733,000 |

Balance Sheet - Liabilities

|

Current Liabilities |

|

|

Accounts Payable |

$2,328,000 |

|

Accrued Expenses |

$0 |

|

Other Current Liabilities |

$3,535,000 |

|

Total Current Liabilities |

$39,200,000 |

| Total Liabilities |

$73,644,000 |

|

Commitments and Contingencies |

|

|

Convertible Preferred Stock |

$45,105,000 |

|

Stockholders' (deficit) Equity |

|

|

Common Stock |

$0 |

|

Additional Paid In Capital |

$21,312,000 |

|

Accumulated Other Comprehensive Income (Loss) |

$0 |

| Total Stockholders' (Deficit) Equity |

$0 |

Statements of Cash Flows

|

Cash Flows from Operating Activites |

|

|

Net Cash Provided By (Used In) Operating Activities |

$7,585,000 |

|

Cash Flows from Investing Activites |

|

|

Net Cash Provided By (Used In) Investing Activities |

$-4,295,000 |

|

Cash Flows from Financing Activites |

|

|

Net Cash Provided By (Used In) Financing Activities |

$8,787,000 |

| Total Cash, Cash Equivalents, and Restricted Cash |

$46,878,000 |

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Synopsis

David Barrett originally founded Expensify in 2008 to help feed the homeless. Barrett later pivoted the idea to a more traditional expense management platform for businesses. Today, Expensify helps businesses track, record, and manage expense reports. It works with businesses of all sizes, but has a special focus on small and medium-sized businesses.

Expensify filed to go public on October 15, 2021. The company is going public in a very hot initial public offering (IPO) market. Many financial technology companies in particular went public in 2021, including Robinhood, Coinbase, Affirm, and many more. Expensify is planning to raise more than $300 million in the offering. The total offering will include nearly 10 million shares at a price range of $25 to $27, valuing the company at more than $2.1 billion at the high end of its price range.

Expensify’s IPO has been rated a Neutral Deal by the KingsCrowd investment team.

Price

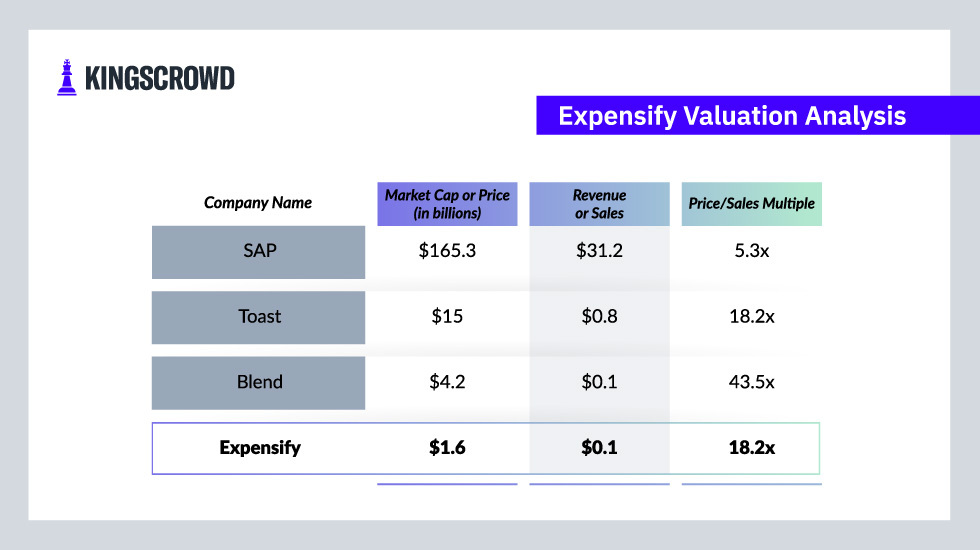

Expensify plans to go public at a valuation of around $2.1 billion. To determine whether this is a fair valuation, it’s useful to compare the company’s valuation metrics to its public financial technology (fintech) counterparts like Toast, Blend, and SAP. SAP is its closest public competitor. Relevant metrics are market cap, revenue and price-to-sales multiple. Enterprise value (EV) and earnings before interest, taxes, depreciation, and amortization (EBITDA) values aren’t as useful, as the majority of Expensify’s comparisons are recently public companies.

Expensify would need to grow about 80% every year for the next five years to justify its current price. Given that the company only grew around 9% from 2019 to 2020, Expensify still has a lot of growing to do. But on a price-to-sales basis, Expensify isn’t overpriced compared to its competitors. While Expensify’s multiple is more than three times higher than SAP’s, investors should consider that SAP is a mature company with several software services under its umbrella. Lastly, Expensify’s revenue multiple is not much higher than the fintech industry average EV-to-revenue multiple of 15x. Overall, Expensify seems reasonably valued.

Market

Expensify is the new-age expense management platform challenging incumbents like SAP Concur. While the market has a few other expense management platforms, Expensify and SAP Concur are the most well-known and most widely used platforms.

The expense management software market is relatively small, estimated at $6.9 billion in 2019 with a healthy annual growth rate of 12.4%. Expensify estimates its total addressable market to be slightly larger at $16 billion in the US and $21.5 billion in the US, United Kingdom, Canada and Australia. Either way, the company’s market size is relatively small. Fortunately for Expensify, there aren’t many dominant competitors aside from SAP Concur. So Expensify has the opportunity to be the dominant software for small and medium-sized businesses (SMBs), which the company has a major focus on.

SMBs make up 99% of US employer firms. So Expensify’s focus on SMBs could set the company up to dominate the expense management software niche. Expensify’s bottom-up, “regular employees” first approach to software adoption is a tried-and-true strategy. If Expensify is able to convert just 10% of SMBs or 10% of its estimated market size, it could potentially quadruple its revenue.

Team

Expensify founder David Barrett first envisioned his company when he was walking through San Francisco’s Tenderloin neighborhood. Barrett wanted to help the homeless individuals he encountered while walking to work. He later pivoted the idea to be a corporate card that would enable small business employees to keep the rewards they received while making business purchases. Today, the company is a unicorn built on the back of a unique culture and an easy-to-use platform.

Expensify’s board of directors and nominee directors will be a group of longtime employees and valuable partners. The company’s board will have eight members: Barrett, Ryan Schaffer, Anuradha Muralidharan, Jason Mills, Daniel Vidal, Timothy Christen, Ying Liu, and Ellen Pao.

The fact that longtime employees are part of the board may indicate the company’s strong employee retention and culture. Both factors could signal that current employees are happy and more top talent may be attracted to join the Expensify team, which could help propel the company’s future growth.

Differentiators

Small- and medium-sized businesses (SMBs) generally rely on manual methods to file and manage expense reports. Even for larger organizations, travel and expense costs are usually a company’s second-highest operating expense. Travel and expense costs tend to be difficult to control. As such, expense management software that can streamline and automate the process can help businesses become immensely more efficient.

Compared to an established platform like SAP Concur, Expensify has several advantages. SAP Concur has a $994-per-year fee compared to Expensify, which can be free or up to $10 per user per month. Not only is Expensify cheaper, but as expected of an innovator in the industry, Expensify is easier to use and easier to set up. Expensify’s low price and ease of use makes it especially appealing to small businesses. Compared to incumbents, Expensify is highly differentiated.

But while incumbents are not much of a threat, Expensify should be wary of new entrants in the expense management industry. Divvy is a new competitor that’s heavily funded. According to reviews from G2 and Capterra, Divvy offers many of the same features as Expensify, but is even easier to set up and use than Expensify. As such, Expensify needs to continue building a strong moat around its business in order to fend off new competitors.

Performance

The COVID-19 pandemic drastically hurt Expensify’s business because of the reduced need for travel and expense management. But the company was able to grow revenues 9.5%. Although not substantial, this much growth during a pandemic year is notable. Gross margins and operating expenses didn’t grow significantly either. Net margin’s negative growth can also be overlooked because it isn’t significant. Lastly, the company experienced a year-over-year decline in marketing and sales because there wasn’t much of a need to market and sell its software in a pandemic year. Overall, the pandemic’s effect on Expensify makes it difficult to accurately judge its financial metrics.

Risks

There are traditional risks that come with investing in any initial public offering, like competition and market risks, but Expensify doesn’t have many other risks. The company’s biggest risk is its product risk. Expensify is solely an expense management software tool. While the company has continued to add to its platform, Expensify needs to diversify past expense management and become a holistic financial platform for businesses in order to establish itself as a dominant force in the market. But fortunately for Expensify, it will not need to diversify anytime soon. The company has plenty of growth opportunities available in small- and medium-sized businesses and beyond. Expensify does have some notable financial risk, but given that the pandemic impacted the business so heavily, it’s difficult to assess how that risk might hinder the company moving forward. Overall, Expensify isn’t an overly risky investment.

Bearish Outlook

Although Expensify is a well-known brand in expense management software, there is a possibility that new competitors could supplant Expensify. The company faces strong competition from Divvy, a new entrant into the expense management industry that offers very similar features and has gotten some better reviews than Expensify. In a bearish scenario, Expensify could lose customers to Divvy or other competitors and lose its position as the go-to solution for any size of business. In that scenario, the company would not be able to grow at the rate that it needs to in order to justify its price.

Bullish Outlook

While the expense management software market is relatively small, there are plenty of reasons to be optimistic about Expensify. As of October 2020, there were 31.7 million small- and medium-sized businesses (SMBs) in the US, and as of December 31, 2020, Expensify had 645,000 paid members. Assuming all of those paid users are SMBs, Expensify will have only penetrated a little more than 2% of its core demographic. There is clearly room for Expensify’s core user group to grow. While Expensify primarily helps SMBs digitize and optimize their expense management processes, Expensify also has growth opportunities with larger enterprises.

Additional bullish scenarios for Expensify include expanding its core features to further monetize its current users and expanding internationally. Expensify has pricing plans that range from free to $10 per user per month. If the company can monetize its free users or even further monetize its current paid users, the company stands to greatly increase its revenue. And with millions of SMBs in its core target geographies, Expensify may be able to grow at an exponential rate. Lastly, as the global economy continues to rebound from the effects of COVID-19, companies will need an expense management platform as business-related activities increase.

Executive Summary

Expensify is an online expense management platform for businesses of all sizes. The company has built a strong culture and brand. Additionally, the company has strong margins, is very lean, and has weathered a pandemic that should have decimated its business.

Unfortunately, Expensify faces a great deal of competition in the expense management software space. SAP Concur is an established and well-regarded platform built for larger enterprises, and newer entrants in the market, like Divvy and Ramp, offer similar features. Expensify needs to continue building a strong moat around its business in order to fend off both new and old competitors. Additionally, the company’s financial position is murky. While the company has weathered COVID-19, the ongoing pandemic has caused abnormal fluctuations in its financials. So it’s truly hard to judge Expensify’s financial health. Despite a murky financial evaluation and competitors hot on its heels, Expensify’s valuation seems reasonable, and its strong margins, culture, and opportunities for growth are promising. Overall, Expensify is a Neutral Deal.

For questions regarding the KingsCrowd analyst report for this company, please reach out to support@kingscrowd.com.

Analysis written by Francis Vu, November 10, 2021.