Venture capital (VC) and private equity spaces have traditionally been male-dominated. Recipients of venture funding have also been predominantly male founders. That remains the case today, though 2021 saw some progress toward a more equal distribution of funding — including increased VC funding, the creation of several women-led funds, and the rise of incubators for female founders.

This week, we’re using three different charts to show the percentage of successful rounds raised by female founders and the percentage of successful rounds raised by female founders with additional VC funds in 2021. (Note: A funding round is considered successful if it managed to meet or exceed its investment minimum before reaching its close date. Startups that don’t meet their minimum in time do not receive any capital from investors.)

Unfortunately, it seems female founders are still underrepresented — and are still receiving a small slice of the VC pie. In 2021, we saw 1,229 successful raises. Out of that, only 291 raises (or 19.1%) had female founders — less than a quarter of all successful funding rounds.

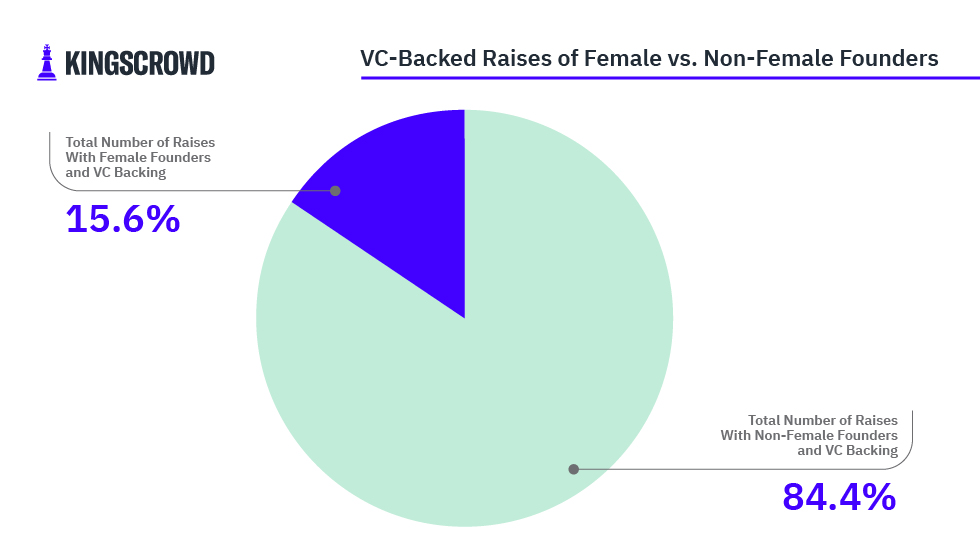

In 2021, only 54 companies raising funds had secured additional VC funding. Just 10 of those companies — 15.6% — had female founders.

So in total, of the 291 raises with female founders, roughly 3% had additional VC funding.

Evidently, women founders are still heavily underrepresented compared to overall equity raises with VC backing. Women founders to date still receive less than 3% of VC funding. This disparity is likely due to heavily ingrained bias in VC spaces.

So if crowdfunding investors use VC backing as a benchmark for their own investment decisions, it could be detrimental to women-founded companies. Fortunately, we know that crowdfunding investors are far more likely to fund female founders than VC investors are. It’s critical for crowdfunding investors to continue diving deep and exploring all facets of a company to determine an investment decision. And if investors are interested in hearing from more female founders, the KingsCrowd companies search page includes a “female founders” filtering option.