KingsCrowd is happy to announce the launch of our new portfolio feature. Not only can you now follow companies you like, but you can also track companies that you invest in across a number of platforms.

Watch this brief video for a demo of all of the capabilities of the newly updated KingsCrowd portfolio management tool.

How to Follow a startup:

First, click on “My Portfolio” in the top menu nav bar.

This will bring you to the page below. To follow a company, click “following” on the right-hand menu bar and follow the prompts-

Once you’ve followed a company, we provide insights into what sector the company is in, what their valuation cap is, and what security type they’re offering, like in this example:

But what if you’ve already invested in some companies or you’re ready to start? Our portfolio also lets you track investments you’ve made across platforms, much like following companies.

How to add an investment to your portfolio

Now, let’s go through how to create an investment portfolio:

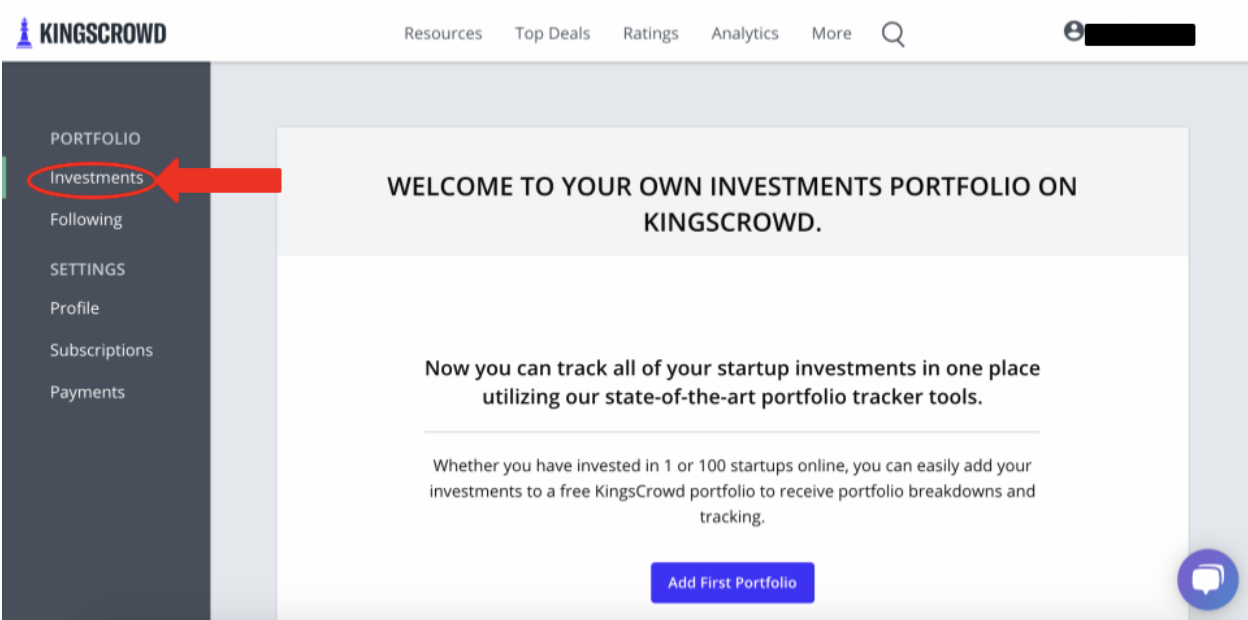

To create an investment portfolio, return to your dashboard menu and click “Investments” on the left-hand bar.

Follow the prompts to add your first portfolio.

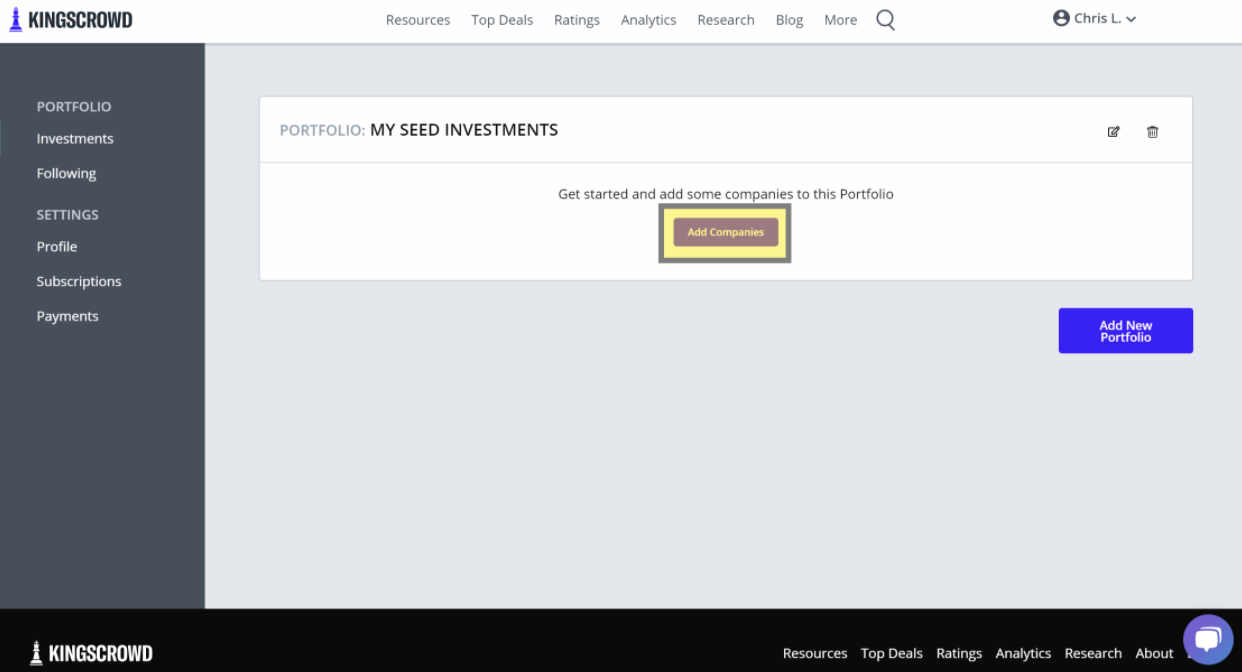

Name your portfolio, give it a simple description, and set your investment limit. It’s as easy as that! Once your portfolio has been set up, you can start adding investments to it.

Adding investments is much like following companies. First, click “add companies.”

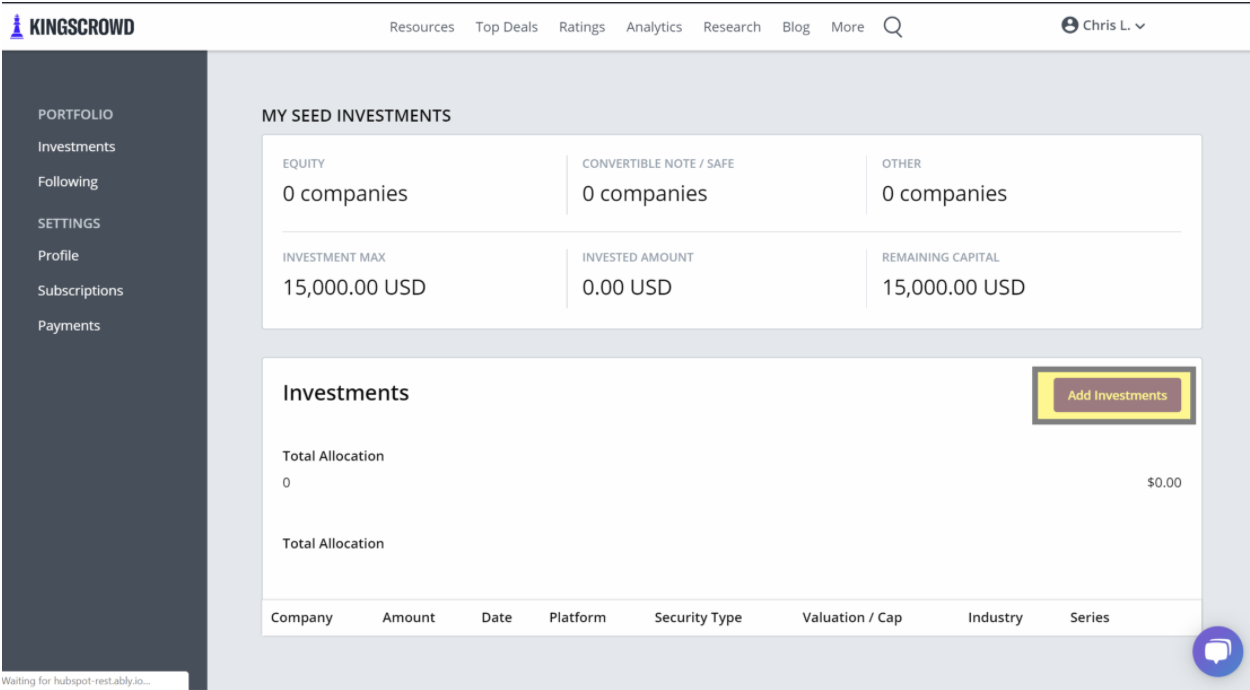

That will bring you to the screen below. Next, click “add investments”-

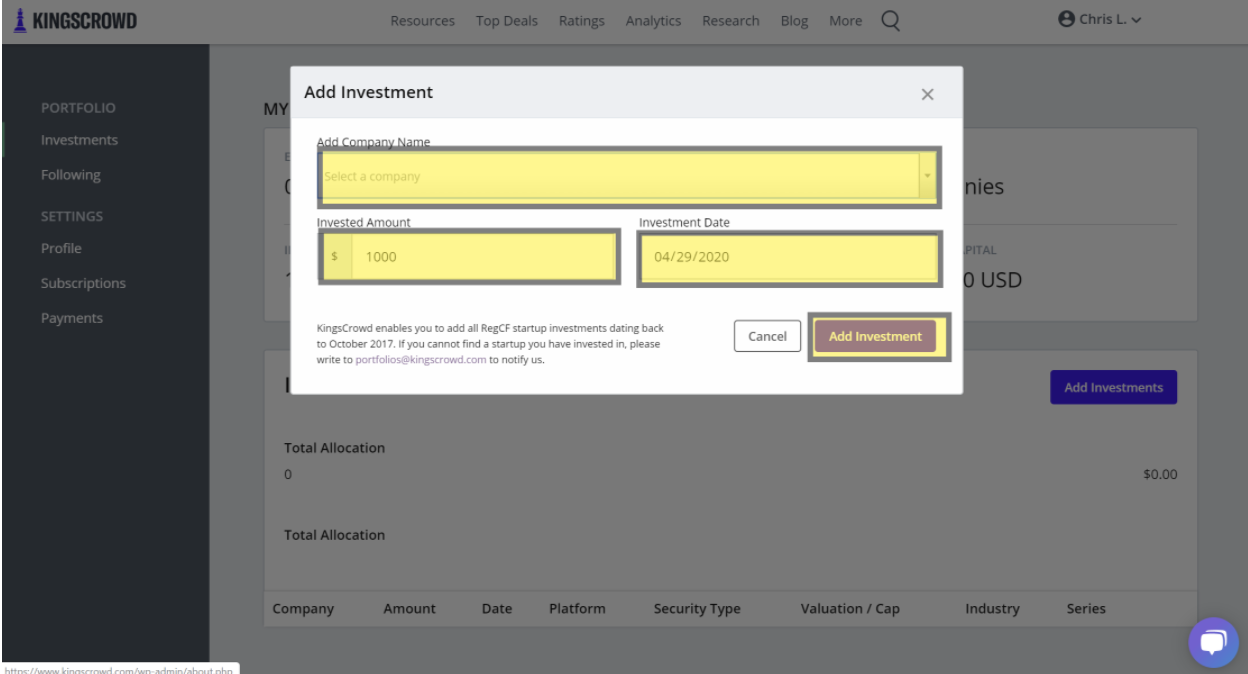

Finally, enter the details of your investments. Repeat for each investment in your startup portfolio.

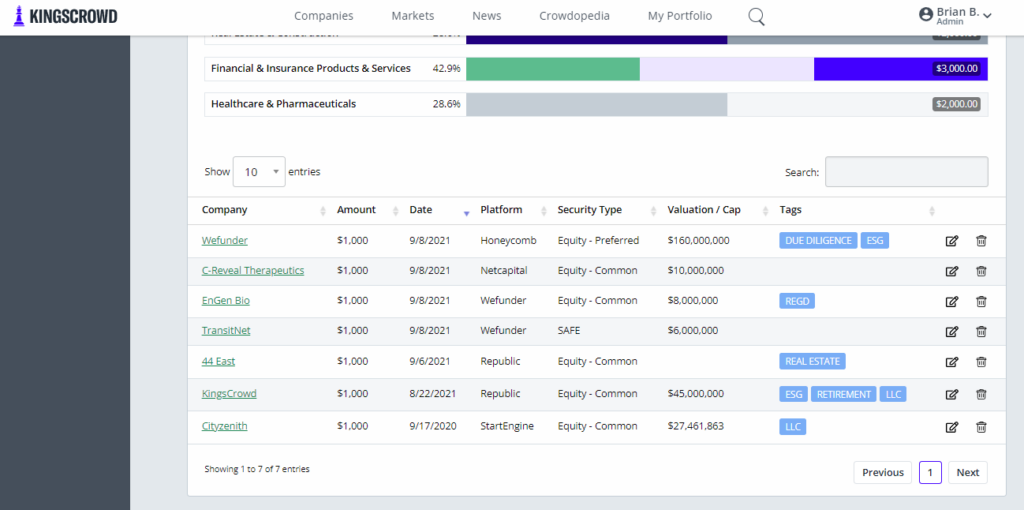

Once you have some investments added in, the value of our tracker really kicks in. We automatically break down how you’re investing your money. We show your investments by the security type, the industry sector, and the amount invested. You can also easily view each company and its raise to see how much time is left and whether they’ve met their minimum or maximum goals.

How to add investment tags

To help you better organize your portfolio, we allow you to add custom “investment tags” to each of your investments.

Some example tags that you could use include:

- LLC vs. C-Corp for the business entity type (important for taxes)

- Taxable vs. Retirement account (e.g. if you invest using your IRA)

- ESG, Social Impact, Minority or Female Founder, etc.

- Did you receive perks? Were those perks delivered?

- Investment year

- And anything else you can think of!

Whatever works for you, the KingsCrowd portfolio keeps your investments organized and convenient.

Happy Investing!