Monogram Orthopaedics

Linking 3D printing, machine learning, and robotics for high precision implants.

Overview

Raised: $14,588,668

Rolling Commitments ($USD)

03/30/2020

$37,991

2016

Healthcare & Pharmaceuticals

HealthTech

Austin, Texas

Raise History

| Offering Name | Close Date | Platform | Valuation/Cap | Total Raised | Security Type | Status | Reg Type |

|---|---|---|---|---|---|---|---|

| Monogram Orthopedics | 05/22/2023 | Dealmaker Securities | $246,000,000 | $15,958,364 | Equity - Common | Funded | RegA+ |

| Monogram Orthopedics | 04/27/2023 | Republic | $246,000,000 | $233,363 | Equity - Common | Funded | RegA+ |

| Monogram Orthopedics | 03/15/2023 | Dealmaker Securities | $155,000,000 | $4,599,145 | Equity - Preferred | Funded | RegCF |

| Monogram Orthopaedics | 02/17/2022 | StartEngine | $89,000,000 | $23,648,853 | Equity - Preferred | Funded | RegA+ |

| Monogram Orthopaedics | 01/15/2021 | StartEngine | $89,900,000 | $2,965,501 | Equity - Preferred | Funded | Test the Waters / RegA+ |

| Monogram Orthopaedics | 03/30/2020 | SeedInvest | $21,250,000 | $14,588,668 | Equity - Preferred | Funded | RegA+ |

Price per Share History

Note: Share prices shown in earlier rounds may not be indicative of any stock splits.

Valuation History

Revenue History

Note: Revenue data points reflect the latest of either the most recent fiscal year's financials, or updated revenues directly from the founder, at each raise's close date.

Employee History

Upgrade to gain access

-

$25 /month

billed annually - Free portfolio tracking, data-driven ratings, AI analysis and reports

- Plan Includes:

- Everything in Free, plus

- Company specific

KingsCrowd ratings and analyst reports

- Deal explorer and side-by-side comparison

- Startup exit and failure tracking

- Startup market filters and historical industry data

- Advanced company search ( with ratings)

- Get Edge Annual

Edge

Summary

The Monogram Orthopedics team has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

The team is currently enabling investors to reserve shares in their upcoming Series A round via Regulation A+. If interested be sure to reserve your shares in this round.

Medical startup Monogram Orthopaedics Inc. stands at the intersection of three exciting technologies: 3D printing, machine learning, and robotics. The firm was founded by Dr. Douglas Unis, a board-certified orthopedic surgeon specializing in adult reconstructive surgery, in 2015 under the name Monogram Arthroplasty Inc. before changing its name to Monogram Orthopaedics in 2017.

For medical technology investors interested in cutting-edge business models that involve multi-layered revenue streams and where success will likely come in the form of a strategic buyout by an industry leader long before the business achieves a sizable share of the market, Monogram stands out as an appealing prospect to consider.

Problem

For the most part, the market centered around the design and manufacture of hip, knee, shoulder, and other implants has been one-size-fits-all in nature. Standardized implants are produced by medical providers, adjustments to them are not easy to make, and as a result, problems abound. As one example, an estimated 20% of patients are left with uneven legs following a hip implant surgery and the costs for correcting said issue can range between $20,000 and $55,000.

Not only are implants not often customized to meet patient needs, the actual procedure can be crude. It’s not uncommon for implants to be hammered into place, which can cause bone damage, and in cases where more advanced equipment is used (like robots), the application of that technology is limited and could have been done manually. Due to the oligopolistic nature of the space, where the top four players make up 77% of the market for reconstructive joints market by means of revenue, there is little incentive by the major firms to innovate.

Solution

By combining additive manufacturing, machine learning, and robotics, Monogram believes it has found the solution to the issues affecting the reconstructive market. First and foremost, by using body-imaging technologies, the company is able to gauge the proper patient-customized fit for each implant on a case-by-case basis, after which it will craft said unit through its 3D printers and have them delivered for surgery.

Each unit will then be inserted with the help of its specialized robot, itself outfitted with hardware and software that will enable it to track parts of the body using digital imaging analysis tools. Today, the robot is considered in its prototype phase, but it is capable of executing auto-generated cut-paths for customized implants.

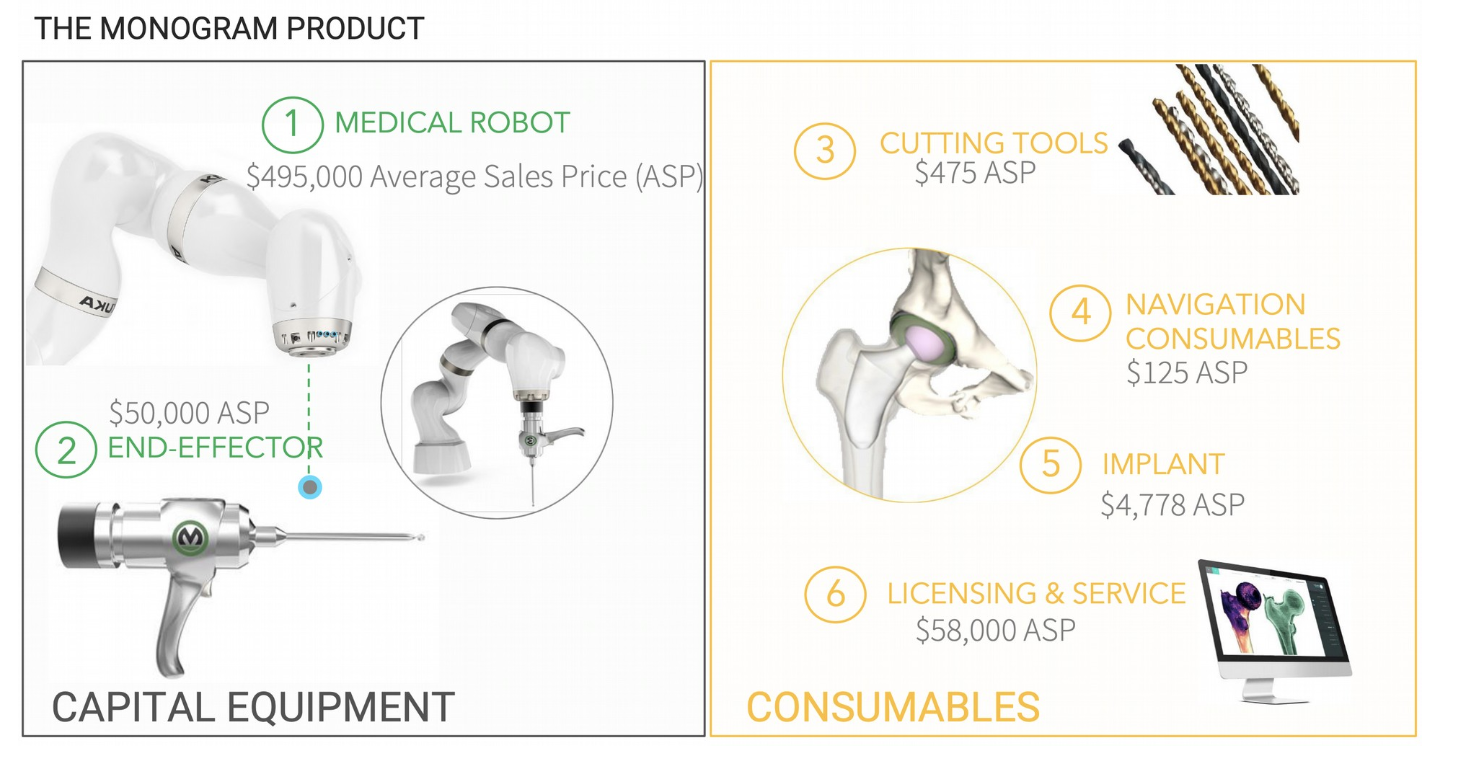

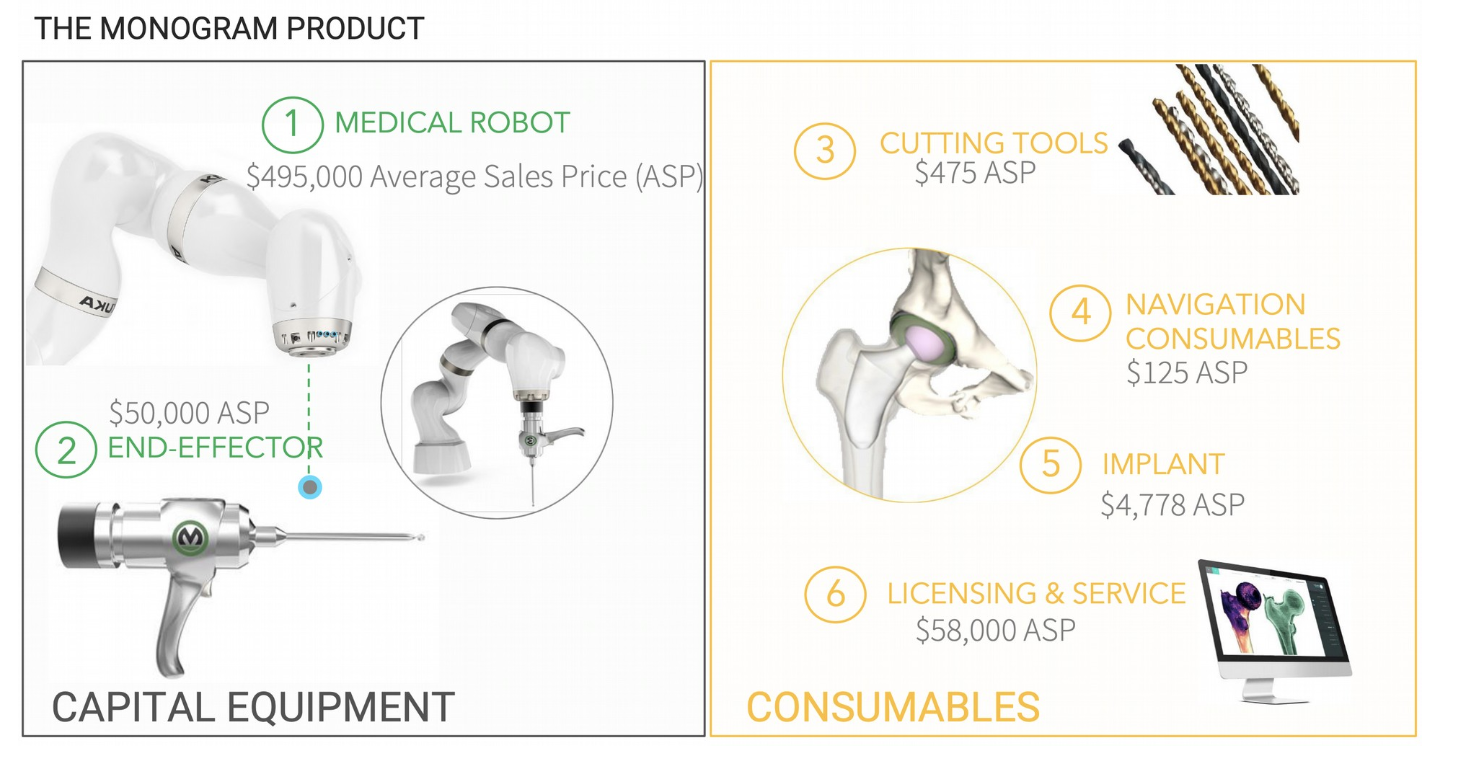

The business model employed by Monogram will offer investors in the company multiple revenue streams. Between the sale and maintenance of the robots, to providing software, and consumables needed before and during the medical procedures are conducted, the company has thought out well on how to turn what might have been only one source of income into many. Examples of pricing and opportunities on this front can be seen in the image below.

A Sizable Market

The broader market for reconstructive joints is significant in size. Globally, the industry is expected to hit at least $20 billion in revenue per year by 2020 (with some sources indicating the market is about $27.2 billion in size) and it’s expected that the market will continue to expand at a rate of about 3.6% per annum for the next several years. The primary driver behind this continued growth is age. According to one source, the average age of joint replacements is about 70, with 60% of patients receiving them being women.

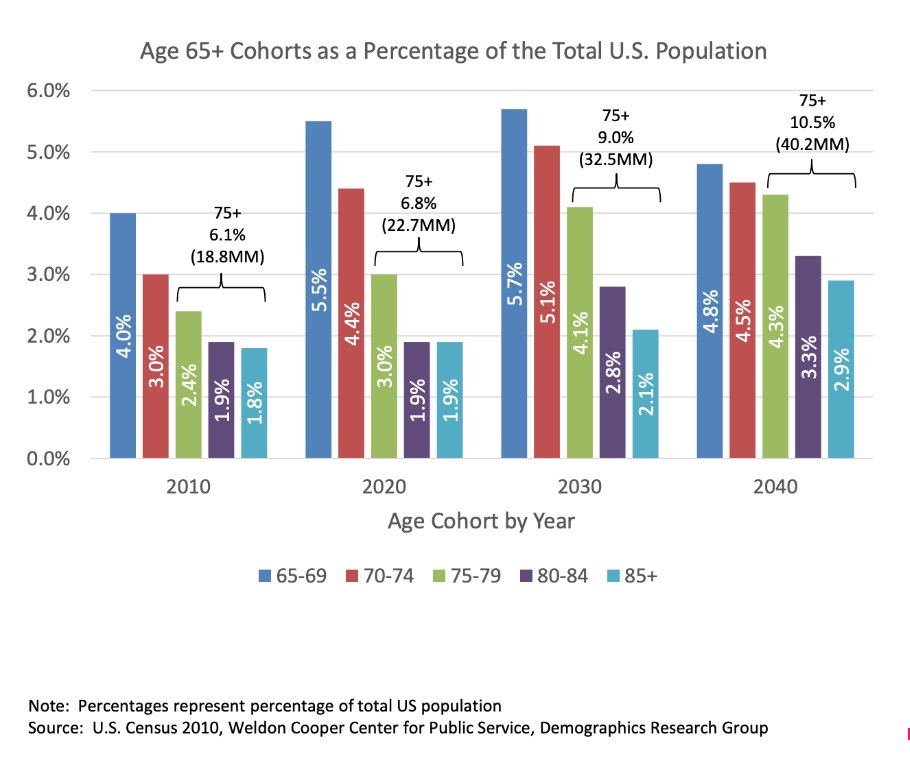

Over time, the number of joint replacements should continue to rise. As you can see in the image above, society is aging. In 2010, 13.1% of individuals in the US alone were aged 65 or older and by 2030 this should increase to 19.8% of the population.

Add to this the fact that the population of the US continues to grow, and the results are impressive. In 2010, the population of the US stood at 309.3 million, meaning that 40.5 million people were 65 or older. By 2030, there will be 359.4 million individuals, with about 71.2 million being aged 65 and up, while in 2040 the 380.2 million people living in the US will result in 75.3 million in the upper age brackets covered.

Outside of the US, there will be opportunities as well. Today, there are over 7.7 billion people worldwide. By 2050, this figure should expand to 9.8 billion. Not only is the population continuing to grow, the wealth of those alive is expanding as well. According to Brookings, over the past few years the global middle class expanded by around 160 million individuals per annum. As population grows and wealth increases, the need and ability for global citizens to buy joint replacements will rise.

At this time, the four largest players in the space are Zimmer Biomet Holdings, Johnson & Johnson (JNJ), Stryker Corporation (SYK), and Smith & Nephew Inc. In 2018, Johnson & Johnson, through its DePuy Orthopaedics unit, generated revenue of $8.89 billion related to orthopedics sales. Stryker, by comparison, generated sales in this space of $4.99 billion, accounting for 37% of its overall revenue.

To some degree, Monogram’s upside will be limited by the adoption of additive manufacturing. In a 2016 report, Frost & Sullivan concluded that the additive manufacturing space would grow at a rate of 15% per annum from $5.31 billion in 2015 to $21.50 billion in 2025 and that, by the end of the forecast period, only 16% of revenues in the space would come from the medical and dental category. This translates to about $3.44 billion so, at best, only a small portion of the $20 billion+ market will be open to the products and services Monogram offers.

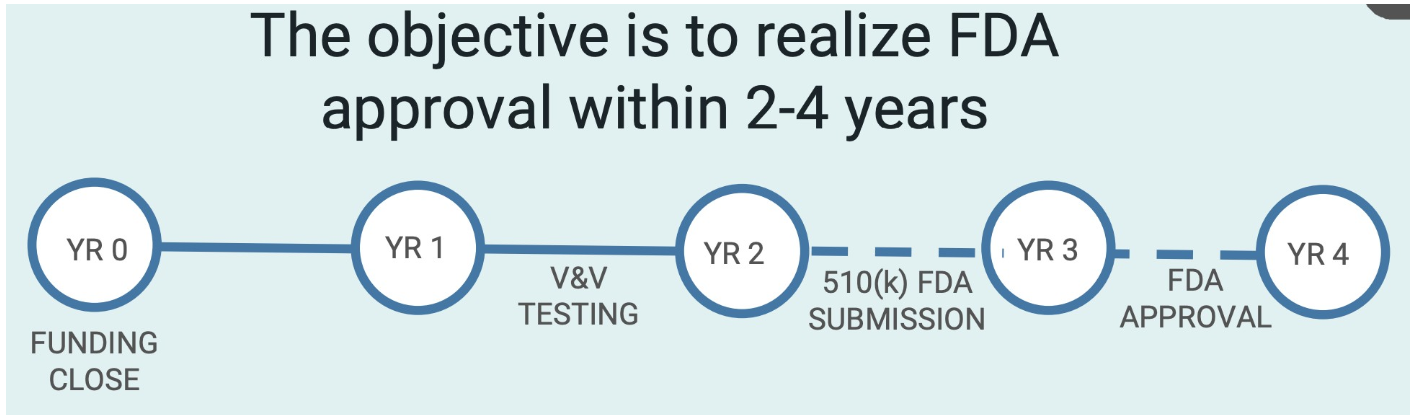

Even so, the company sees for itself an attractive path forward. According to management, it has elected to rely on the 510(k) pathway for its go-to-market strategy. This method allows the company to file for approval with the FDA under Monogram’s assertion that their technology is substantially equivalent to other offerings already out there, meaning that if the FDA agrees, it could save the business years of work and likely many millions of dollars worth of capital.

Between the first and second year following the close of its funding round, the business would work on the verification and validation of its offerings, while the periods between years two and four would see it submit its application to the FDA and, hopefully, see an approval from the agency.

If all goes according to plan for the company, it has a strategic plan forward to get from where it is today to generating revenue. Management intends to work with at least nine different universities and medical centers across the US to get its offerings out into the market initially and if this comes to fruition as the firm projects, it could generate revenues of between $10 million and $20 million annually. One of these prospective partners is Mount Sinai Hospital in New York. At this time, Monogram does not own any trademarks or patents, but it is licensing IP from Mount Sinai so a partnership with that institution, which itself owns 17.10% of the common stock the business has outstanding.

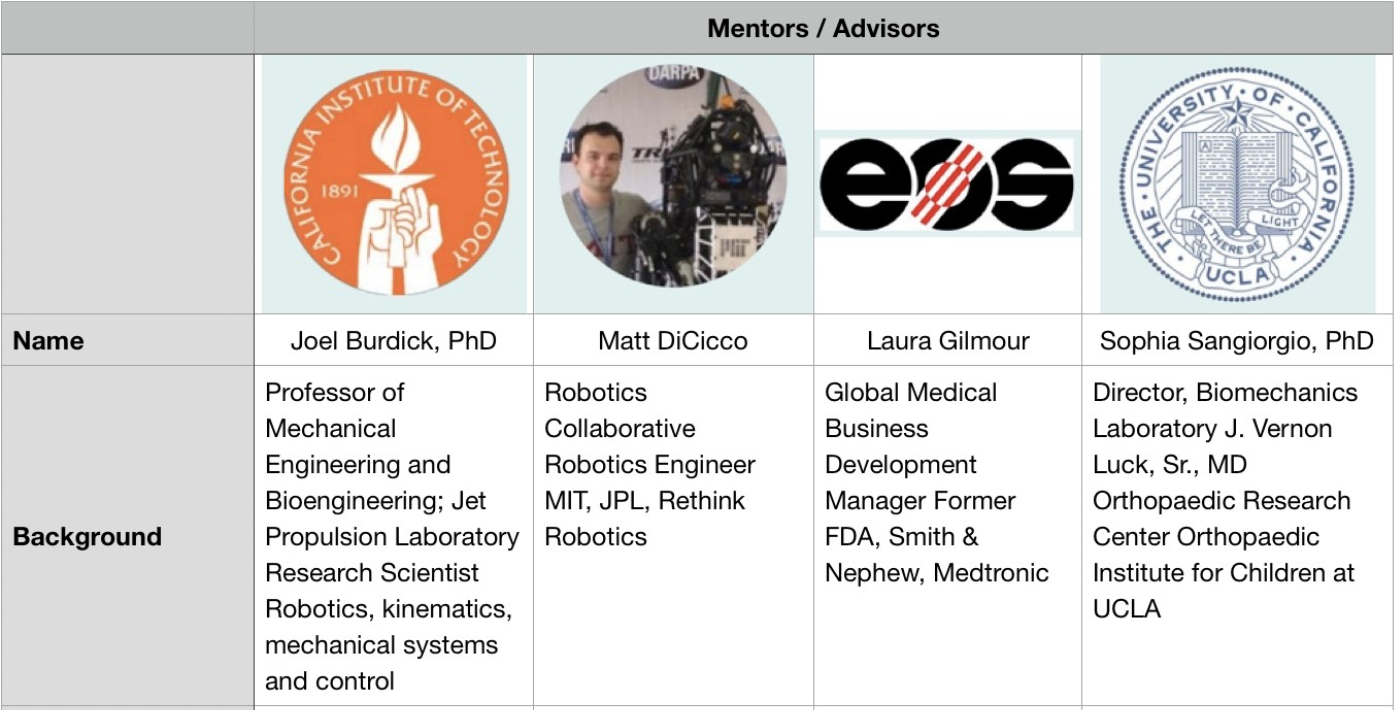

A Focus on Management

A strong business model and good technology is integral to the success of any firm, including a startup, but perhaps equally important is the quality of the management team and broader support network affiliated with the firm. Unlike some startups but like most medical technology ones, Monogram has a sophisticated leadership team and a robust network of advisors. Specific details about this support network can be seen in the tables below.

Terms and Other Details

Medical technology endeavors are expensive and often take years before revenue can be successfully generated. Monogram is no exception in this regard. In its latest fiscal year, the company brought in no revenue, but it did incur expenses totaling $712,268, more than half of which ($378,523) was associated with payroll and related costs.

Actual operating cash flows during the year were -$306,865, but despite this significant cash outflow, the company ended its 2018 fiscal year with $922,108 in cash and cash equivalents. Even with this cash cushion, the firm’s auditor felt compelled to issue a going concern note in its audited financial statements.

A going concern note indicates that the auditor does not believe the company can remain in operation until it reaches profitability under existing circumstances, and should come as no surprise to investors who are well-acquainted with the space. Due to the significant capital investments required in order to receive government approval, most early-stage firms in the medical technology space likely have this qualifier, but this does serve to underscore both the risk inherent in investing in a startup of this nature and it’s a sign that the company very likely will have to raise even more capital in the years to come, especially if the regulatory process with the FDA drags on.

To get to the point it’s at today, Monogram has already invested a material amount of capital. Across multiple rounds (no fewer than four), the firm has raised $2.152 million, all of which appears to be in the form of convertible notes bearing a weighted-average interest rate of 5.7%.

For the current round of funding, the company is searching for up to $20 million in cash in exchange for Series A Preferred Stock, with a pre-money valuation of $21.25 million. Initially, each unit of preferred stock will be exchangeable for common on a one-to-one basis (adjusted in the future for stock splits and other events) and they will each carry a vote comparable to the common. This simple, straightforward ordering of the preferred units is generous because in some cases management will elect to restrict voting rights and/or some other actions by incoming investors that might harm the interests of the founders. This is not the case here.

The allocation of any proceeds brought on by the firm will vary materially depending on how much of its $20 million raise it achieves. In its filing documents, the company stated that the lowest raise it will close on is $7 million. In this case, for instance, and as the image below illustrates, 58% of cash proceeds will go toward continued product development, but as the amount raises grows, this allocation will shrink.

Upon the full $20 million raise, 41% of capital proceeds will go toward product development, with the rest split between working capital and other company-related expenses. It is worth mentioning that, irrespective of the size of the close, 10% of all proceeds will be charged as offering costs and paid to SI Securities in the form of commissions for their work done in facilitating the raise.

The Rating: Deal To Watch

Monogram Orthopaedics is a Deal To Watch. It is an interesting medical technology startup focused on modernizing a sizable but slow-changing space. Part of the industry’s slowness when it comes to change stems from the regulatory environment, but it would be wrong to disregard the oligopolistic nature of the industry as a key factor as well.

These large players and a tight regulatory market can hinder quick adoption of this service in hospitals, especially if the additional cost of this technology cannot materially reduce cost tied to better patient outcomes.

Due to the concentration of the industry toward four major players, it’s probable that any success generated by Monogram will eventually lead to the company being absorbed by one of the space’s leaders. Ultimately, this could prove a better route than having to undergo, over time, hundreds of millions of dollars worth of raises, each time resulting in significant shareholder dilution, as the firm not only receives FDA approval, but then moves on toward scaling up its business.

With an intriguing technology that is well into its development lifecycle, an experienced team and a market ripe for a new solution with exit opportunities clearly identified, this is one worth watching.