I see every one of my startup investments as part of my overall investment portfolio. Even if I’d like all my investments to perform well, I know that probably won’t happen. Early-stage startups are risky investments by nature. So I try to build an overall strategy that helps to mitigate risk. Part of this strategy is the amount I invest in each startup. There are different personal factors that influence my check size — how much I make, how much I am willing to risk, how much I want to get back from my portfolio in 10 years. And I am also influenced by the company itself — what do I think the return will be, how confident am I in the market, how exceptional is the opportunity.

The amount an investor puts in a raise is a personal decision, but I can’t help being curious about what others are doing. Knowing the check sizes of my fellow investors gives me an idea about their confidence, their risk-aversion, and their wealth.

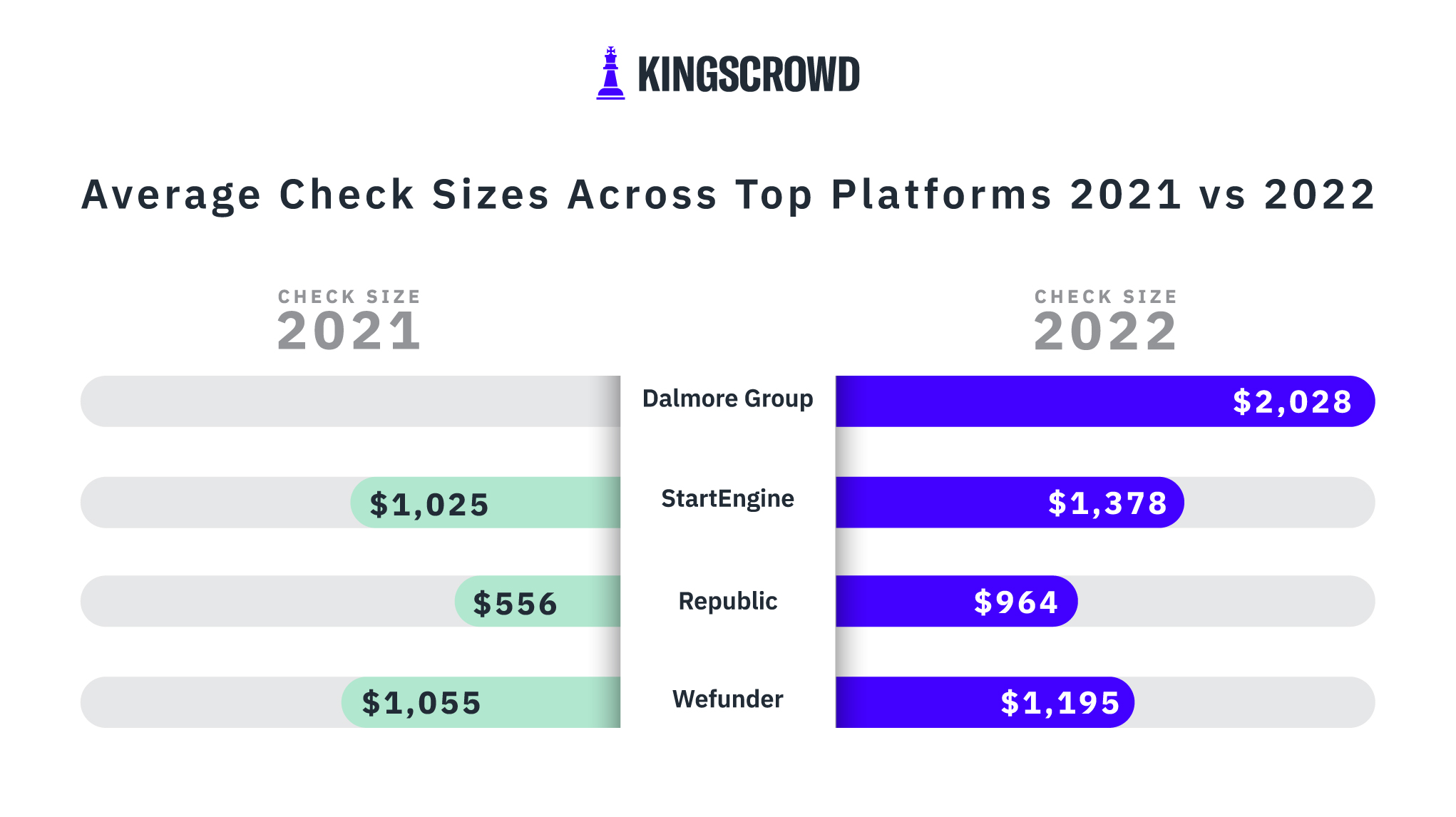

So this week, we’ll turn our eyes toward the top four online startup investing platforms and compare average check sizes for equity deals between 2021 and 2022. (Note: 2021’s figures are for Regulation Crowdfunding (Reg CF) raises only, while 2022 includes both Reg CF and Regulation A (Reg A) deals.)

On StartEngine, Republic, and Wefunder, investors’ check sizes increased between 2021 and 2022. That might be surprising considering that total dollars invested fell in 2022. But it mostly comes down to math. The amount invested in Reg CF deals on each platform decreased, but less than the number of investors — this explains the higher check size year over year.

I have a theory for why we saw fewer investors in 2022 — shifts in wealth. In 2021, many people had more savings stocked up because the pandemic made them cut down on traveling, transportation, and entertainment expenses. Since they had money to burn and fewer ways to spend it, we can imagine that many new retail investors tried investing in startups for the first time that year. With the pandemic declining and economic volatility rising, these new investors might have diverted their funds from investing to spending or saving. With fewer first-time and risk-averse investors on crowdfunding platforms, the average investor is probably now wealthier and willing to write higher checks than in 2021.

Dalmore has the highest average check size of the industry. Its market is slightly different, as it primarily hosts Reg A offerings, which have a high limit of $75 million per year. As a result, the platform attracts investors with bigger checks. While we do not have enough data to confidently share Dalmore’s investor check size in 2021, we look forward to watching investors’ behavior on Dalmore in 2023.

Last year’s check sizes are encouraging. They show that despite there being fewer investors in 2022, some investors are still confident in the online startup investing market. They are backing startups, and they’re probably onto something. From cases like Airbnb and Slack, we know that some of the fastest growing startups were born during economic downturns. Bear markets are scary, but they’re also times of great opportunity.

Note: All data on online startup investing used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the U.S. crowdfunding market.

“Platform” is defined here as the SEC-registered intermediary (broker-dealer or funding portal), or if none, the primary non-broker or non-funding portal platform conducting the offering.