Just two months ago, Republic announced that it had acquired Fig, a crowdfunding platform for video games. Now another company has joined the Republic ecosystem — Compound!

Compound is a crowdfunding platform that gives all investors (accredited and unaccredited) access to real estate ventures. Specifically, Compound specializes in apartment buildings in growing cities like Austin, TX and Miami, FL.

We talked with co-head of Republic Real Estate Janine Yorio to learn more about real estate investing and how it can supplement an equity crowdfunding portfolio. Janine told us that, similar to startup investing, real estate investing has been historically exclusive. Until recently, real estate investments were limited to accredited investors. Janine, like us, is excited about democratizing investment opportunities and using early-stage investing as a tool for wealth generation. “You can own real estate with $500 or $5000,” she told us. “You don’t have to be a millionaire first.”

Compound’s deals operate under Reg CF and use Crowd IPAs. The Crowd IPA is a security similar to membership units. This is notably different from the SAFE or a revenue share deal, in that the agreement is not for future equity. Specifically, returns could come in a number of forms: the return of capital dividends, capital gain dividends, or dividends from current or accumulated earnings or profits.

Real estate investing is similar to startup investing in that it is a long term game. It’s also a good way to diversify an early-stage investment portfolio because real estate tends to be stable and reliable. The returns on real estate are traditionally lower than startups, but there is also much less risk involved.

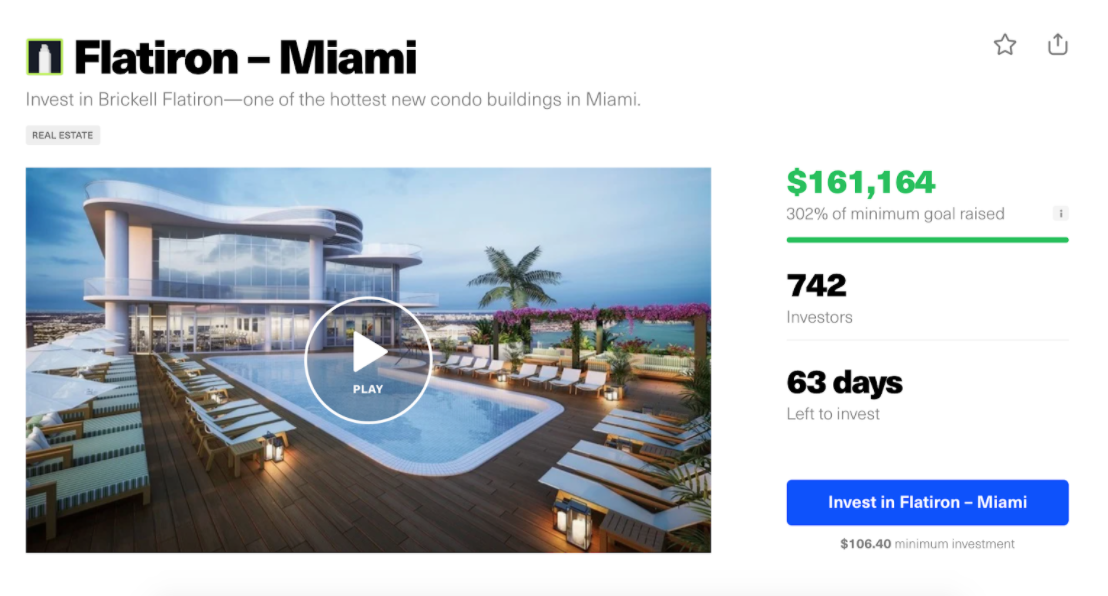

Currently, Republic is hosting three live deals via Compound: Flatiron- Miami, 44 East- Austin, and Illume- Nashville. Investment minimums are $106, $258, and $115, respectively.