So far in the Sector Spotlight, we’ve covered Technology and Food & Drink. Today our focus is on the Consumer Products sector. The same disclaimer applies that 2020 data is going to be skewed due to lack of a complete year of data.

All graphs are made by the author.

Offer Details

We begin by considering the number of offerings within the sector to see what the potential competition for investment dollars (and offering success is). While we saw a decrease in offerings from 2018 to 2019, this sector appears on track in 2020 to exceed its prior year total of new offerings.

After a dip from 2018 to 2019, the average round minimum has ticked up slightly in 2020 and is right in line with the 3-year average. Given the average amount raised in 2018 and 2019, I wouldn’t be concerned about this uptick so far in 2020. And with the discussions around raising the max raise, we could potentially start to see an increase in offer minimums as well.

The success rate for offerings in 2020 is below the overall average for the prior two years. As with last week, I chalk some of this up to the active status of a number of the 2020 offerings, although the sector average is below what we are seeing across all sectors (which is closer to 70%). However, based on what we’ve seen in the prior years’ numbers and other sectors, the success rate should climb as we head into the summer months.

The average amount raised so far in 2020 is about $100K less than the average amount raised in 2019. However 30 of these 38 offerings are still active, so there is plenty of room to make up some ground. Though with the $100K lag, we may be looking at numbers closer to 2018 than 2019, especially with the potential impact of COVID-19 decreasing some crowdfunding investment.

There is a long way to go in 2020 (we’re only a third of the way through, though it seems like it’s been much longer than that), but hitting the 458 average investor mark in 2020 might be a tough bar to meet. As I mentioned above, there is still plenty of opportunity to boost this number, as a majority of the offerings are still active, but a 300 investor per offering increase might not be in the cards this year given the current circumstances. Time will tell.

Offer Platforms

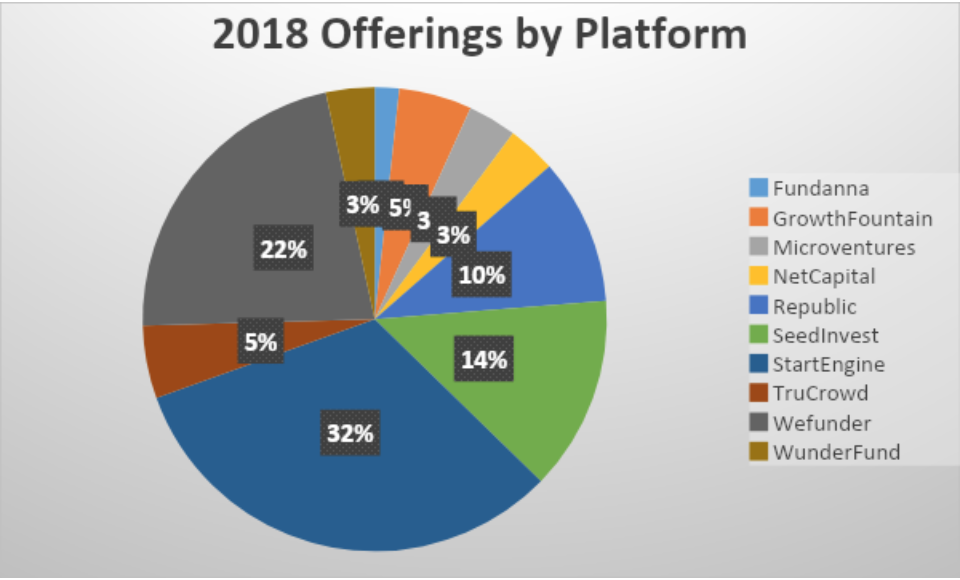

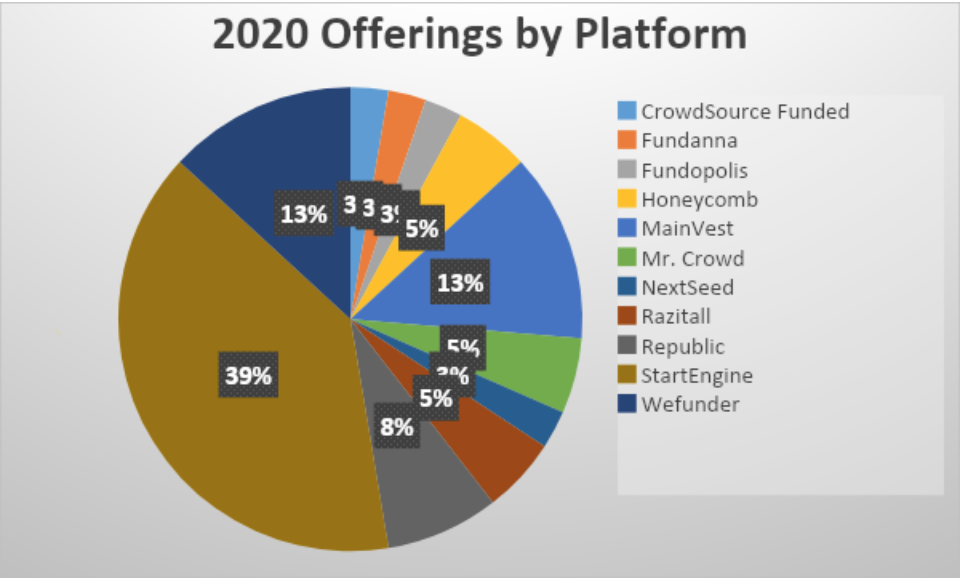

In this next section, I break down where the Consumer Products offerings have positioned themselves on the various offering platforms, in total and by year.

StartEngine and Wefunder combine to take up over 50% of the Consumer Products market, but what this graph tells us is there are a large number of platforms who have some skin in the game when it comes to this sector.

As with the overall pattern, StartEngine and Wefunder claimed over 50% of the market share in 2018, with only two others (SeedInvest and Republic) crossing the 10% threshold.

In 2019 we saw some newcomers to our data, with MainVest, Fundopolis, Honeycomb, Mr. Crowd, and Razitall making their first appearance in our data for this sector, slowly chipping away at the market dominance of StartEngine and Wefunder.

2020 has seen StartEngine start off in a dominant position, with MainVest providing WeFunder with some competition for 2nd place in the market. As the year goes on, it will be interesting to see if some of these smaller players can increase their market share…and at whose expense.

Financials

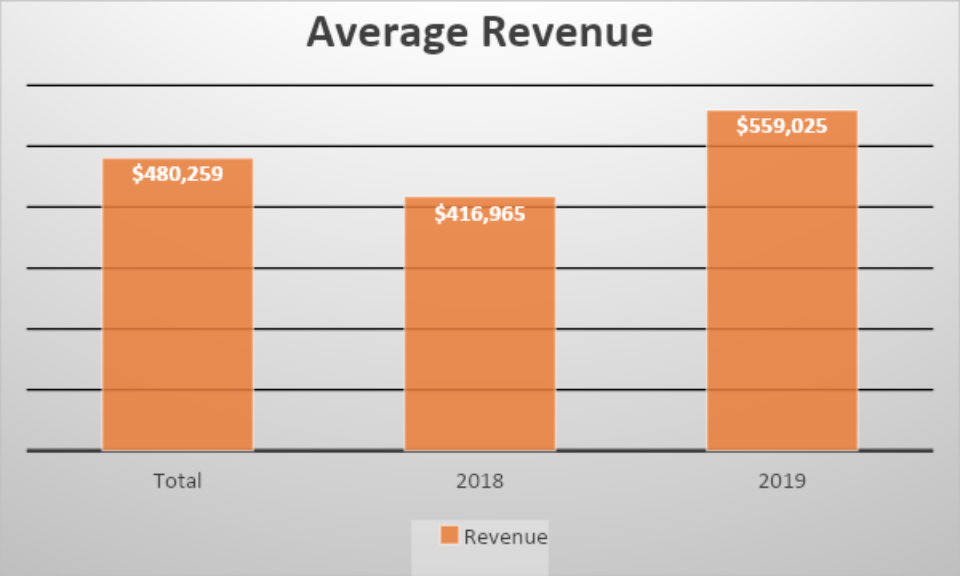

Finally, some statistics on the financial data for some of the companies raising capital through Reg CF. This information is obtained directly from a company’s SEC Form C filing. Information is not yet available for 2020.

As may be expected, a lot of companies raising money through Reg CF are still in their early stages, and have not yet turned a profit. Similar to the Food & Drink firms last week, 2019 saw an increase in net losses for firms raising capital through Reg CF. A potential explanation is the increase in technology costs these firms are incurring to get their products to market and interact with their consumers. Another year of this trend though should start to trigger some alarm bells, especially if we see more increases in revenue (as we will see below).

At the same time these firms were losing more money, they managed to increase revenues in 2019. This potentially squares with the losses discussed above if these new firms saw high revenues at the expense of increased tech spending and customer engagement. We plan on keeping an eye on how revenues move in 2020 and what impact this has on net incomes in the year to come.

Some Consumer Products firms KingsCrowd is looking at:

Slash Haircare – A Deal to Watch

Bum Butts – An Underweight Deal

ZAMii – An Underweight Deal