One of the most exciting benefits of investing in startups is the possibility of significant returns – as much as 10x, 50x, or 100x on a single investment. But in order for companies to provide these kinds of returns, their target market needs to be able to support their growth. Even if a company has all other factors for success in place, a target market size that’s only in the range of a few millions will likely mean that investors will see limited returns. So where should return-focused investors look to find high-potential startups?

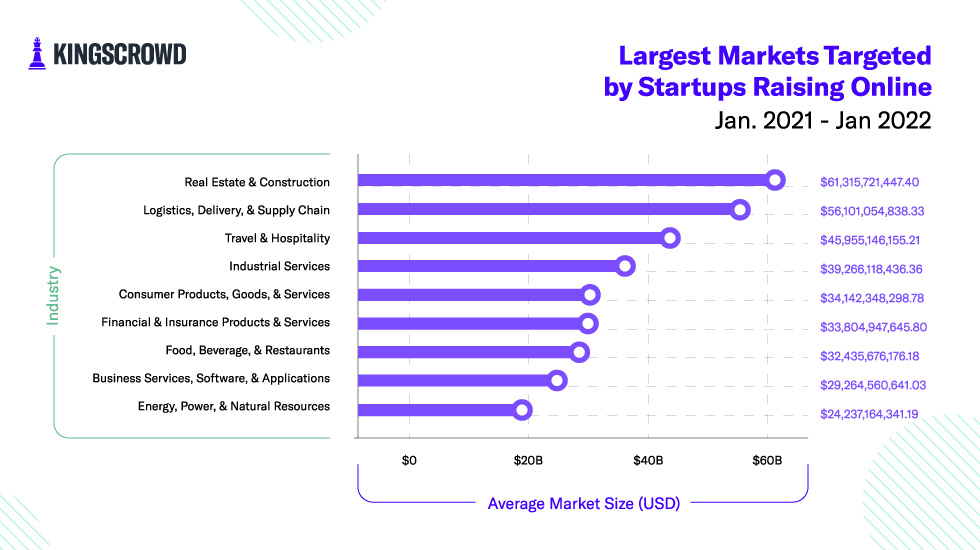

In this Chart of the Week, we determined the top industries in terms of average market size. We examined all Regulation Crowdfunding (Reg CF) and Regulation A raises from January 2021 through January 2022 to see what markets startups are targeting. Then we calculated the average market size across more than 20 different industries to find which were the largest.

The real estate & construction industry came in at the top of the chart with an average size of $61.3 billion. There were only 66 startups within the real estate & construction industry, which indicates that the target markets for these companies are often substantial. Logistics, delivery, & supply chain came in as the second largest market with more than $55 billion in value on average. At the lower end of the spectrum, three industries have average target markets that are below $10 billion in size – retail shops & department stores, fitness & wellness, and pet health, food, & services.

Investors can use this data as they look for high-potential startups (KingsCrowd Pro and Merlin Members can even use the Companies Search tool to filter by industry across all tracked deals). However, it is very important to keep in mind that how much of a particular market a company can capture can be more important than the value of the industry itself. A startup that is able to capture 10% of a $20 billion market is better than a company that only captures 1% of a $60 billion market. Lastly, the growth rate of the target market is also an important factor when evaluating a company. Stay tuned for more data about market growth rates next week!

Note: all data used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.