Top Deal: Redefining Digital Grocery

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

The Locai Solutions team has been selected as a “Top Deal” by KingsCrowd. This distinction is reserved for deals selected into the top 10% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology please reach out to hello@kingscrowd.com.

The grocery industry is experiencing a paradigm shift. Consumers are changing their buying habits from instore to online. Online retailers like Amazon are thriving in this environment, while traditional brick and mortar businesses suffer. Locai Solutions is a multi-faceted SaaS-focused startup providing the technology needed to keep brick and mortar businesses competitive. Each suite of applications is expected to enhance the online experience and create value for the retailer.

Problem

In the past couple of years, consumers in the US have finally begun to trust and rely on e-commerce to meet their grocery shopping needs. Now, after lagging other countries in adoption like the UK and South Korea, Pandora’s Box is deemed opened and the only path forward is a world where more and more of society’s grocery needs are fulfilled without the end consumer ever having to leave their home.

As might be expected, this has created multiple problems for traditional retailers, namely that it has placed pressure on their relationships with their clients. By shifting to an online environment, brick-and-mortar players have begun to lose a connection with their customers. Not only that, shoppers in this new era want to have their cake and eat it too. They want the convenience of shopping online, but they also want their products now and with no additional fees added on.

This has caused issues for the companies operating in this space. Online order fulfillment, both in-store and direct-to-consumer, has not only created logistical and cost concerns, but it has also resulted in in-store aisle congestion as employees race to prepare orders. As a result, it has impaired staff productivity while inconveniencing the valuable consumers who are still willing to grace the retailers’ stores.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Solution

Most startups focus around one, perhaps two, major products or services, but Locai Solutions is not your typical startup. With over $5 million invested into its foundational technology, the company has created an ecosystem that has a suite of solutions baked into it, each one dedicated to some vital offering aimed at improving the online shopping experience for consumers while creating value for retailers. The first of these worth mentioning is CookIt.

CookIt is a digital meal planner for consumers that provides personalized recipe recommendations. Through the program, not only can consumers plan their meals, when they find recipes that they like, they can buy all of the ingredients needed with only 1-click. Another offering under the Locai banner is the company’s Searchandising engine, which enables digital shelves that presents products shoppers want. Both of these solutions are aimed at creating or restoring trust between retailers and their customers. By tethering consumers to a system, it creates built-in loyalty that is lacking in most shopping platforms.

If you imagine CookIt and Searchandising as cost centers for traditional retailers, then on the other side of the coin is cost minimization software like the company’s PowerPick order fulfillment application. According to management, PowerPick helps to maximize productivity by using what the firm calls intelligent batching and routing of orders. In addition, it offers inventory oversight and management services, effectively working to reduce out-of-stock issues. Also, though its Vendor $ offering, the company opens the door for additional revenue opportunities by placing paid advertisements on its CookIt and Searchandising platforms.

In the image above, you can view management’s own visualization of its various offerings, while in the image below you can see how the company’s ecosystem is supposed to work. In short, its clients have the ability to sign up for any one of its services, but the real value of the startup is what management refers to as its microservices architecture. On the left side of the image, you can see the company’s own applications, while on the right you can see that the firm has created the ability for third-party applications to be added onto its platform. This is done through an API and applies the benefits of agility and flexibility to its customer base.

This microservices architecture varies radically from what management has categorized as the monolithic architecture that is typical of incumbent software and services providers. These older, bulkier platforms tend to be less user-friendly and because the solutions offered through them tend to sit within the same overarching architecture, they are more difficult to alter and keep up-to-date, and at times can be more difficult to integrate with new technologies. The API-oriented, plug-in compatible setup developed by Locai is a different story.

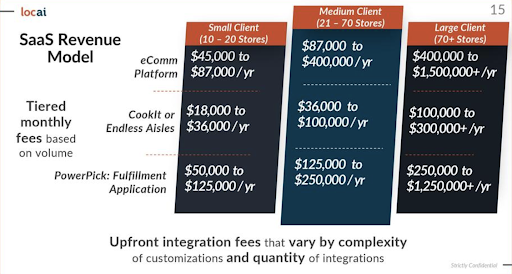

If all goes well for Locai, the company believes that the price it can charge for its services is significant. In the image below, you can see their projections for three different size categories of clients. Set in tiers based on product offerings and size, the company plans to allow the retailers in question to pay for only the services they need most, but the objective of their SaaS model is to maximize revenue by demonstrating to their clients the value of all of their offerings over time.

In initial field tests, management maintains that the results of their technology have proven accretive to their clients. In one case, the company tested order information in February of 2019 (prior to the rollout of their platform to the client) compared to May of 2019 (a month in which its services were being used by the unnamed client).

According to management, the average order booked by the client online rose from $117 to $141. The bounce rate during that same timeframe declined by 19.8%, new user traffic rose 30.2% thanks to organic search engine improvements, and the average time of a visitor on the site grew 12.5%. On top of this validation, the company stated that its technology has been validated on eGrocery with over 20,000 orders per week and over 1 million in total being completed, with average order sizes coming in at about $200 and more than 100,000 different products indexed.

Though the company is still young, it has done well to prove its revenue strategy. In 2018, sales generated by the business totaled $58,000. Through 2019, the business projects revenue to be $282,000, while in 2020 it is forecasting sales of around $3.65 million. For projected results, management can realistically put any estimate they want since the only thing to know about any estimate is that it’s likely wrong, but if their forecasts are accurate, then in 2023 they believe the company will generate sales in excess of $44 million.

From a profitability perspective, the results thus far have been as-expected for a startup: dismal. According to management, the company not only generated a net loss in 2018, its operating cash flow for that year was -$854,862. With $589,739 in cash and cash equivalents on hand at the end of 2018, it still has some runway to go, but this raise, as well as future raises, will be necessary for the company to continue its planned growth trajectory.

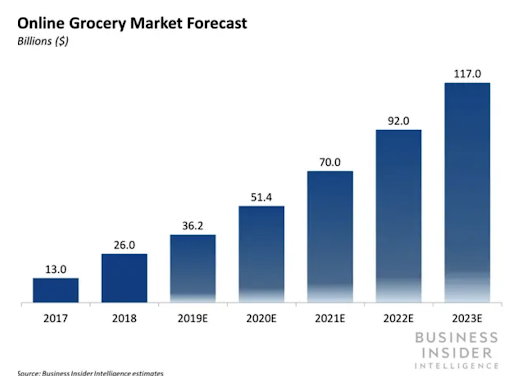

The Market

Though surprising as it may sound, buying groceries online is still in its earliest phase of adoption. According to once source, in 2018, online grocery shopping represented only $26 billion of all grocery sales across the US. This was double the $13 billion seen just one year earlier and is a small fraction of the $632 billion overall grocery shopping industry.

Between 2018 and 2023, it’s expected for the market to surge higher, rising to $117 billion in size. Forbes, citing data from the Food Marketing Institute that was collected by Nielsen, expects slightly lower growth, with the opportunity in this space rising to a more modest (but still impressive) $100 billion by 2025, accounting for roughly 20% of all grocery retail spending.

Outside of the US, the opportunity could be even greater. In the US, it’s estimated that in 2018 only 10% of US consumers regularly shopped for groceries online, but even these purchases are smaller than those made in-store, with between 3% and 4% of all grocery spending conducted in the US through online channels.

In all, only 25% of consumers have ordered any groceries online in the past year, and just 6% of all consumers order groceries online more than one time per month. In other nations, like the UK and South Korea, penetration in the space is as high as 15% of all spending. One source looked at 10 large nations and, in the image below, looked at the growth that it anticipates for the period ending in 2023.

As you can see, the market opportunity according to eMarketer is estimated to be smaller in the US than the other sources indicated, but even if this forecast is correct, the opportunities overseas more than make up for this. In China, the online grocery business is forecasted to expand from $50.9 billion to $196.3 billion by 2023, while in Japan it should grow from $31.9 billion to $46.5 billion despite the country’s forecasted population decline. Across the 10 nations covered during this five-year window, the market should expand from $147.9 billion to $374.9 billion.

The one big risk appears to be from major market players who are unlikely to utilize the company’s services and opt, instead, to bank on their own internal offerings. The biggest being Amazon. In addition to now owning Whole Foods and operating its Prime Pantry, the e-commerce giant offers AmazonFresh (same-day delivery service) in some select cities, and there is also the uncertainty of having to compete with an enhanced brick-and-mortar solution like AmazonGo. Of the $26 billion in online grocery sales completed in 2018, Amazon accounted for about $2 billion. The next-largest competitor is Walmart, with about $1 billion in online sales attributed to the grocery category during the year.

It would be disingenuous to state that the existence of big and rapidly-growing e-commerce platforms like Amazon are all risk for Locai. If Locai can grow fast enough and perform well enough at a fundamental level, it could become a buyout target instead of a foe to be overthrown. Any major player wanting to capture more of the e-commerce space might find value in the company’s offerings and seek to acquire it instead of competing with it, meaning that investors in Locai should consider the biggest players both as competitive risks and potential strategic exit prospects for the business.

The Terms

The terms of the current transaction through which Locai is seeking capital are fairly simple and straightforward. According to the Form C filing of the business on the SEC’s EDGAR Database, investors are acquiring Series Seed Preferred Stock in the company at a pre-money valuation of $6.5 million. The minimum investment per person comes out to $1,000 and, in all, the company is seeking to raise up to $2 million, with a minimum target of $250,000. As of the time of this writing, the business has already reached that threshold, with $526,533 in all raised.

According to the filing, the Preferred units issued by the business are convertible into common units at any time and at the discretion of the holders of the units. This is uncommon, as there is usually a trigger or conversion date that determines this, but it’s nice for investors to have that flexibility. The Preferred units do have voting rights, but for non-major investors (those who have allocated less than $25,000), these rights are limited, and such rights only exist for as long as 25% of the Preferred units remain outstanding.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

An Eye on Management

At this time, there are two key members on the Locai Solutions team: Mike Demko and Scott DeGraeve. Mike Demko is Locai’s founder and CEO. He has over 20 years of success in executive roles in this space, including firms like Door to Door Organics, Ask.com, FreshDirect, and Priceline. His expertise include operations, marketing, product development, financial planning, turnaround management, and M&A, and prior to working at the aforementioned firms, he graduated from Princeton University with a BS and MS in Engineering, and he received his MBA from Wharton. Scott DeGraeve, the company’s COO, is an experienced practitioner in the online grocery space. He has more than 20 years of hands-on experience in eGrocery. Prior to his time at Locai, he founded one of the first online grocery companies, eventually selling the firm to Peapod where he spent 15 years serving on its executive team.

The Rating: Top Deal

Locai Solutions has been rated a Top Deal by KingsCrowd.

The company is unlike most startups in that it’s launching a suite of value add and cost reduction offerings, which should appeal to companies moving from brick and mortar to online. Millions of dollars have been invested in the product and management has extensive experience in the industry. Sales trends continue on a positive path and future projections look promising. Locai appears to be well-positioned in a rapidly growing market to provide a vital service to its customers and possibly set itself up to be acquired by a larger player in the segment.

Investors need to be wary of competitive pressures in the segment by the Amazons and Walmarts of the world. Potential dilution is a reality as management will most likely continue its quest for capital in order to grow the company, so future raises are inevitable due to the high cost and continued cash outflows associated with developing the concept. Regardless of the associated risks, the opportunities appear to outweigh the risks in this rapidly growing market segment.

About: Daniel Jones

Daniel Jones is a graduate of Case Western University with a degree in Economics. He has spent several years as an equity analyst writer for The Motley Fool where he focuses primarily on the Consumer Goods sector but also likes to dive in on interesting topics involving energy, industrials, and macroeconomics, in addition to contributing equity research to publications such as Seeking Alpha.