Deal To Watch: A Vertical Takeoff Aircraft

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

Jetoptera has been selected as a “Deal to Watch” by KingsCrowd. This distinction is reserved for deals selected into the top 10%-20% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology, please reach out to hello@kingscrowd.com.

The aviation industry is one of the largest and most vital industries on the face of the planet. Every year, companies search for new ways to safely move both products and people over continents and across oceans. Much of this innovation is centered around making the costly business of flight more affordable and more accessible than in the past. One company with the vision of creating the most attractive aerial mobility solutions of the future is Jetoptera.

Problem

Air travel, whether for commercial, military, or recreational purposes, is costly. In 2018 alone, airline fuel costs totaled $180 billion, and this figure grew to $200 billion the next year. Fuel costs remain so high due, in part, to the significant weight of aircraft and the required energy to lift them off the ground. Other issues, like payload, distances traveled, and weather conditions, are also contributing factors. Alternative aircraft, such as helicopters, seek to address some of these concerns, but their design comes with its own set of detriments, including noise levels and a large footprint.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Solution

Wherever there’s economic opportunity, innovation will find a way to creep in, and there are few industries as economically large as the aviation space. In the US alone, aviation was responsible for $1.7 trillion in economic activity last year and employed more than 10 million individuals. As the planet’s population grows, and as countries become more global in nature, air travel will only grow.

One company looking to capitalize on this growth trend is Jetoptera. Its goal is really two-fold. First, it is working on the design and production of fluidic propulsion systems. Second, the company is also developing its new lightweight airframe, which is meant to reduce the weight of an aircraft by around 30%. To understand a little better, it might be wise to dig into each of these concepts.

According to management, Jetoptera is energy source agnostic. Having said that, it has relied recently on gas generators as its main fuel source. Once converted, the exhaust from the gases “entrain and accelerate ambient air.” Their design allows for vertical and short takeoff and landing, making the craft more energy efficient and eliminating the need for a runway. The machines are also quiet, with some units running at just 70 dBA at 400 feet. For perspective, an analysis from Yale found that a vacuum cleaner typically runs at about 75 dBAs. Meanwhile, a normal conversation between humans is usually between 60 and 70 dBAs. Taken together, Jetoptera’s fluidic propulsion systems are both more efficient and much quieter than current aircraft in use.

The firm’s airframe technology, meanwhile, utilizes ceramic matrix composite (CMC) materials as well as carbon and glass composites. These are all aimed at creating durable and lightweight structures for their aircraft. While the company does design its own CMC materials, it has at least one type licensed through NASA.

In its quest to provide diverse products and services to its clients, the company has planned for several different offerings. Initially, it began with the J-55, the smallest of its vehicles, but they have plans in place to scale their craft all the way to the J-9000, which would have a payload capacity of 2,000 lbs. Jetoptera is planning a wide array of aircrafts with varying payloads and speeds. They are looking to maximize their market by making their products available to the US military as well as commercial parties, and eventually to recreational users.

In the construction of its J-55 unit, Jetoptera partnered up with the Aviation segment of General Electric and the US Navy. This year it hopes to build and test its J-220 design as well as General Electric’s H-80 technology. If all goes according to plan, Jetoptera thinks it can begin selling its services to the military sometime this year. Below, you can see the company’s planned development timeline through 2024. Gradually, the firm moves more toward larger, more sophisticated aircraft.

Although 2019 financial results have not been provided by Jetoptera, odds are they probably look a lot like 2018’s results. That year, the company generated nothing in the way of revenue, and its net loss in 2018 was a hefty $1.66 million. In 2017, once again, the company saw no revenue. This lack of revenue, combined with operational expenses, led to a net loss of $1.16 million. Operating cash flows in 2018 and 2017 were -$1.59 million and -$1.18 million, respectively. It is likely that net losses and negative cash flows will persist as research and development ramps up. This state will probably continue even as the company moves into the early sales stage of its lifecycle. One thing that will help mitigate these losses is the licensing out of its own technologies. Licensing is a high-margin activity, but it’s uncertain at this time just how much demand there will be for it.

A Large But Opaque Market

The aviation space is one of the largest in the world. Just on the commercial and goods transportation side alone, revenue in 2020 is forecasted to be $872 billion. The system is expected to transport 4.72 billion passengers and 62.4 million freight tons of goods. With a projected industry profit of $29.3 billion, the profit margin in the space is only 3.36%. That percentage creates incentive for industry improvements, because even a marginal increase in profitability can be hugely valuable.

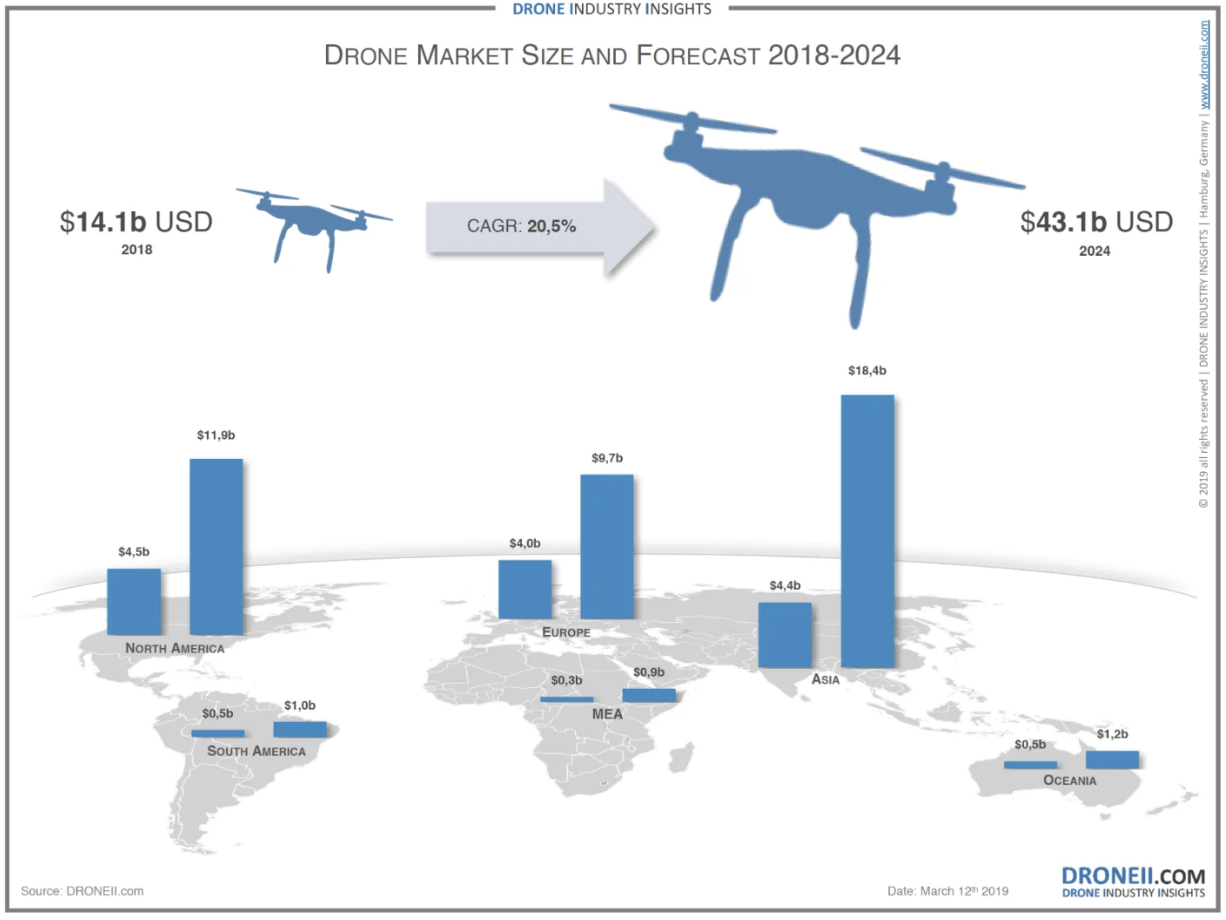

While the goal for Jetoptera might be to serve as an alternative to all types of aircraft, that’s a long game to play. In the short-term, attacking particular niches of the space makes a lot of sense. On the small side of aviation, there is the drone/UAV space. According to one source, the global drone space was about $14.1 billion in size back in 2018, with $4.5 billion of this market residing in North America, $4 billion in Europe, and $4.4 billion in Asia. It’s expected that the space should grow at a rate of 20.5% per annum through 2024, at which point it will be about $43.1 billion in size.

Not all sources agree about the size of this piece of the drone/UAV industry. Another source, for instance, estimated that the global market was $9.70 billion in 2018 with over half that attributable to North America alone ($5.71 billion). That source forecasts slower growth, though still at an impressive rate of 12.54%, through 2026. If this forecast turns out to be accurate, the market that year will be about $27.40 billion in size. That same source also made an interesting observation. A full 82% of the drone / UAV market today by market value is occupied by military spending. Recreational and commercial/civil account for the remaining 18%.

If you move out to the broader aviation market, things become very big, very quickly. In 2019, $143 billion worth of aircraft were delivered to the commercial aviation industry. It’s believed this should expand to around $180 billion by 2023. These amounts cover only the primary sales market though. Last year, $43 billion in financing transactions were completed in the secondary market. Additionally, aircraft sales represent only a fraction of this space because the leasing of aircraft is another major area of the market. According to one source, a full 49% of the global fleet of commercial aircraft are leased. Leasing, then, could be an attractive area for Jetoptera to play in over time.

Terms of the Deal

In its transaction, the management team at Jetoptera has chosen a pretty conventional approach. The company is looking to raise between $25,000 and $1.07 million. Investors, in return, will receive Crowd Notes that carry no interest rate. These notes do, however, convert at a discount rate of 20% upon the next conversion. This discount means that if the firm were to raise capital at a $10 million pre-money valuation, investors would see their notes convert as though the company were being valued at $8 million. All shares received upon conversion will be non-voting preferred units. To get early money contributed to the raise, management also offered a sweetener. The valuation cap for the first $50,000 committed will be set at $22 million. For all investors after, this increases to $24 million. As of this writing, Jetoptera has $92,478 committed to its raise.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

An Eye on Management

At the core of the Jetoptera team are three primary individuals. All three are co-founders of the firm and all three have PhDs. The first of these is Denis Dancanet, the company’s CEO. Denis is a private pilot who, prior to founding the company, had a career in quantitative finance. He was Partner at PDT Partners, a leading quantitative hedge fund, and Managing Director at Morgan Stanley. Denis has a PhD in Computer Science from Carnegie Mellon University in the theory of programming languages.

Next in line is Andrei Evulet, the firm’s CTO. Andrei has an extensive background in R&D, technology maturation, and aerospace engineering. He spent nearly 15 years at General Electric, including in the technology groups at GE Global Research, GE Oil and Gas, and GE Aviation. At GE Aviation, he was the Technology Integration Leader and Technology Maturation Leader for the GE9X engine. Andrei earned his PhD from Rutgers University in Mechanical and Aerospace Engineering. He also has a Master’s of Science in Aerospace and Propulsion Systems Engineering from the Polytechnic Institute of Bucharest.

The final cofounder is Simina Farcasiu, Jetoptera’s CFO. Simina has various entrepreneurial experience in software, energy finance, and aerospace. She also has an extensive background in investment management, quantitative analytics, capital markets, and investment banking. Her early career was spent on Wall Street, at First Boston, Merrill Lynch and Bear Stearns. Simina earned her PhD from Westfield College and her BA from Princeton University.

The Rating: Deal To Watch

After careful consideration, Jetoptera has been rated a “Deal To Watch.” The company’s technology is innovative and promising. The fact that it has partnerships with the US Navy and the Aviation segment of General Electric is incredibly encouraging. The leadership at the top of the firm, in the form of its three co-founders, is excellent. The large (though opaque) market the firm operates in is also destined to grow for the foreseeable future. If the company’s technology does pan out to be as good as it seems, the upside for shareholders could be material.

There are few downsides, but downsides they are, nonetheless. The first is the absence of revenue, which makes everything more challenging, not only for Jetoptera, but for any startup. Revenue further validates the product and brings in additional cash flow the firm can operate with. Without revenue, it’s challenging to justify a high valuation like the $22 million to $24 million cap it’s currently seeking. It also adds the risk of a liquidity crisis sometime in the future. These are all legitimate concerns and investors should be cognizant of them when evaluating whether or not to make an investment. However the potential upside if the company gets this right could well be worth the risks.

About: Daniel Jones

Daniel Jones is a graduate of Case Western University with a degree in Economics. He has spent several years as an equity analyst writer for The Motley Fool where he focuses primarily on the Consumer Goods sector but also likes to dive in on interesting topics involving energy, industrials, and macroeconomics, in addition to contributing equity research to publications such as Seeking Alpha.