Top Deal: The Crypto Hedge Fund For Everyone

Key Stats:

| Valuation Cap |

Amount Raised

N/A |

Number of Investors

N/A |

|

Minimum Raise

N/A |

Maximum Raise

N/A |

Likelihood of Max

N/A |

|

Start Date

N/A |

Stop Date

N/A |

Days Remaining

|

|

Security Type

N/A |

Investment Minimum

$N/A |

Deal Analytics |

Summary

The Ember Fund team has been selected as a “Top Deal” by KingsCrowd. This distinction is reserved for deals selected into the top 10% of our due diligence funnel. If you have questions regarding our deal diligence and selection methodology please reach out to hello@kingscrowd.com.

The cryptocurrency market is both large and fast-growing. Rising adoption rates among investors have turned this space mainstream. This has created significant opportunities for those bold enough to place their money in this space. With opportunities, though, come significant risks as well. Fraud is growing and costly, and the area is complex to the uninitiated. This creates uncertainty and confusion about how and where to place one’s money.

Problem

Investing in the cryptocurrency market is challenging and risky. According to CoinMarketCap, there are at least 2,369 different cryptocurrencies on the market today. Many of these have attributes that make investing in them unattractive. But for the average person dipping their toes into this market, that is not readily apparent. This creates performance-related risks that can lead to substantial losses over time. In addition, fraud is an ever-present and growing threat in this market. Hackers and other fraudsters are becoming more adept in thwarting digital currency exchanges and the security built to protect them.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Solution

Ember Fund has been set up by its founders to address the aforementioned problems plaguing the cryptocurrency space. At its core, the company is operating an app that allows users to place money into it and to use that money to invest in cryptocurrencies. Unlike traditional DIY (do-it-yourself) options, though, Ember Fund gives its users the ability to place their money in one of multiple the professionally-managed funds.

This removes the guesswork and individual analysis that DIY investors should perform regularly. According to management, the pre-picked portfolios have been vetted. This helps to alleviate concerns over investing in illegitimate cryptocurrencies. The hope is that these managed funds will generate stronger, less volatile, returns for investors than the DIY approach might. The company does also allow investors to pick their own cryptocurrencies to invest in.

*Taken from Ember Fund

There are other cryptocurrency opportunities on the market, but Ember Fund’s non-custodial structure differentiates it from its peers. In most cases, a user’s investment assets would be placed in an account that a broker has custody over. This means that the broker holds the assets in its own account(s). There are certain benefits to this. Examples include being able to rely on the broker to recover forgotten/misplaced login information, and having a large financial institution at your back that’s willing to ‘fix’ problems should a mistake arise. The downside to this though cannot be understated. There is a long history of hackers breaking into these brokers. Unlike US securities, which are covered by the SIPC, and cash that is covered by the FDIC, there exists no such protection for cryptocurrency investors.

To combat this, Ember Fund has founded its technology on the concept of a private wallet. This private wallet is owned and controlled by the investor in question. They control and have custody over their assets at all times, as well as the login credentials to them. It’s important to know that all of the sensitive information on the system is encrypted. This entire arrangement does create some risks. One of the biggest is the possibility of a user misplacing the wallet and/or forgetting the login information. This can render the user unable to access his or her investments. Should Ember Fund find itself hacked, though, the non-custodial wallet is to keep its clients’ assets safe.

*Taken from Ember Fund

Another benefit to how Ember Fund has been set up is that it’s not dedicated to a single cryptocurrency exchange. Instead, the company’s algorithm receives a trade order and checks each of the 8 exchanges it is connected with. It does this in order to find which exchange will offer the best trade for its clients. Management estimates that this method saves its users between 1% and 2% of their trade value. This makes the company’s plan to monetize the platform by charging a 1.5% transaction fee seem fair.

*Taken from Ember Fund

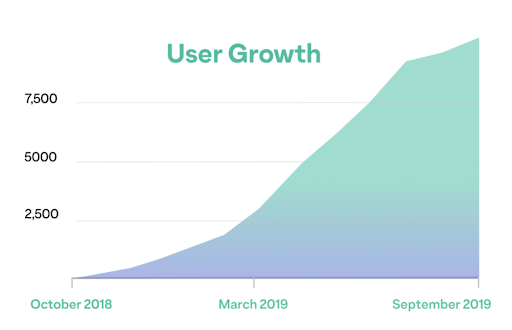

Since its launch in October of 2018, Ember Fund has seen attractive growth. As of this writing, the business has conducted more than $10 million worth of transactions and it has more than 15,000 downloads of its app out there. Total deposits are around $4 million today. According to management, the company is generating $150 in revenue per user each year. This compares favorably to its $50 per user CAC (customer acquisition cost). In 2020, management hopes to scale up to 18,000 users from the roughly 10,000 seen today. With average revenue per user of $80, based on $2,000 for an average deposit, the company expects to see revenue next year of $1.5 million. By 2026, the company is targeting 1 million users and $100 million in revenue. This should be taken with a grain of salt since forecasts are always far from certain.

What limited operating history does exist is not impressive. 2019 financials have not been provided, but data for the period of October 2018 through the end of last year is. Revenue then was only $1,710, and the company’s net loss was $24,523. Given the business’s rapid growth this year and how far into the year we are, significantly higher revenue appears all but certain. The bottom-line results, however, could be anybody’s guess.

One interesting thing for investors to consider is that the platform as it stands today is rather limited. As of this writing, the company offers users the ability to invest in only 13 different cryptocurrencies. This limitation is likely due to management’s desire to create managed products. By only focusing on a list of vetted, quality cryptocurrencies, the company can establish itself first and grow over time. The composition of their list, though, is intriguing.

Names like Bitcoin, Ethereum, and Ripple make perfect sense. However, the company is missing some big names while including others that have not really been known to investors before. Tether is perhaps the greatest example. At this time, it is the fifth-largest cryptocurrency on the market by means of market capitalization with a value of $4.12 billion. Ember Fund does not have it, but it does have one called AppCoins, which is ranked number 541 with a market cap of only $3.60 million. It would be interesting to understand management’s rationale behind their choices.

The Market

*Taken from Statista

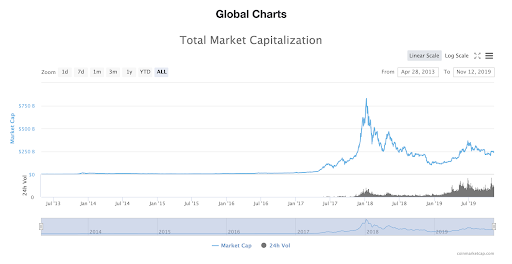

Ember Fund operates in a large and growing market. There are two ways to measure this: first by user size and second by the implied market cap of the industry itself. Let’s begin this analysis by focusing on user size. In the image above, you can see the number of blockchain wallet users across the globe over the past three years. Back in the third quarter of 2016, this number stood at only 8.95 million. Today, that figure is 42.29 million. Despite the cryptocurrency space reporting a massive drop in market value in the past 22 months (pictured below), the number of users continues to rise. Just a year ago, the number of blockchain wallet users stood at 28.89 million. That implies growth over the past year alone of 46.4%.

*Taken from CoinMarketCap

The other way to look at this is through the lens of market value itself. As the aforementioned image illustrates, the total market value of all 2,369 cryptocurrencies is $246.16 billion. Of course, most of this value is consolidated among the biggest players in the space. Bitcoin’s market value, for instance, stands at $158.20 billion, accounting for 64.3% of the industry total. All of 13 cryptocurrencies that Ember Fund has chosen to work with so far have an aggregate value of $204 billion, or about 82.9% of the industry total.

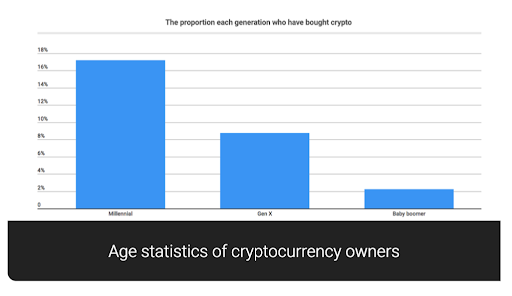

Not only is this space large and growing over time, data suggests that there’s more room to grow in the future. According to one source, only 8% of American adults own some form of cryptocurrency. Men are two times more likely than women to place their money there. Breaking up the data further, you arrive at some interesting, but predictable, conclusions. Millennials (ages 22 to 37) are more likely than their elders to own any cryptocurrency. This number falls at 17% compared to 9% for people classified as Generation X, while for Baby Boomers it is a paltry 2%. For those who do own cryptocurrency, the goal appears to center around using it as an investment. Only 8% of holders plan to use it as a payment method. It is likely, though, that as adoption increases and as firms like Facebook open up to digital currency, this number could change.

*Taken from ICO Making

One issue that is omnipresent in this space is fraud and theft. According to one source, in the first half of 2019 alone, $4.26 billion worth of cryptocurrencies was lost. The cause: a mix of theft, hacking, scams, and fraudulent activities. This represents a significant increase over the $1.7 billion lost through 2018. This just goes to show that as more people move toward this space, greater emphasis will be placed toward bad actors looking to get in. Ember Fund’s answer to this is their non-custodial wallets. These, they claim, will make their clients more secure than if the company itself held onto its clients’ assets.

Terms of the Deal

The transaction that Ember Fund is looking to close is rather simple and straightforward. According to its filing document, the company is looking to raise at least $25,000, but its preferred aim is for $1.07 million. As of this writing, investors have contributed $159,290. In exchange for the cash received, investors will be given a SAFE. This operates as a security that converts into equity upon the next round, after a specified time and/or upon other triggering events. This particular SAFE converts at a 15% discount to the future valuation of the business, subject to a $5 million valuation cap. In order to participate in this opportunity, investors must contribute at least $100 toward the deal.

Wall Street has Morningstar, S&P, and Bloomberg

The equity crowdfunding market has KingsCrowd.

Management

Though there are several people working on the Ember Fund team, the company revolves around three core individuals: Alex Wang, Guillaume Torche, and Mario Lazaro. All three are labeled as co-founders of the business. Wang serves as Ember Fund’s CEO. Prior to his time running the business, he was employed as a Product Manager at a company called GumGum. Before that, he founded and eventually sold Carapace Wetsuits. Torche serves as Ember Fund’s CTO.

In the past, he held senior data scientist and data engineer positions at various startups. This includes Tastemade, where he served as its Staff Backend Engineer and as a specialist in machine learning. Before working at Tastemade, he was employed as a lead backend data engineer at GumGum. Lazaro currently serves as Ember Fund’s CIO. His latest relevant work experience was at GumGum where he, too, served in lead engineer and engineer management roles.

The Rating: Top Deal

Having weighed the opportunities and risks, Ember Fund has been rated a “Top Deal”. The company’s business model is robust and compelling.

It has found ways to differentiate itself from the bulk of the competition out there. This is accomplished by providing users a seemingly safer way to invest. Not only that, the company is doing so while catering to those who want to invest in cryptocurrency but aren’t sure where to start. The early traction generated by the company is significant so far. If the revenue per user that management has stated is accurate, the revenue trajectory of the firm is appealing. To top it off, the company’s valuation cap of $5 million appears quite low. This is especially true if it does generate its forecasted $1.5 million in revenue next year.

This is not to say the offerring is without risks. Competition in what is already a crowded space is sure to be fierce, but that does not mean the company cannot succeed. The bigger concern might be on the legal front. There are fine lines a firm has to walk to avoid broker/dealer registration. The same can be said of avoiding registration as an RIA (registered investment advisor). The regulatory environment around these kinds of companies is undergoing significant change. This could easily add significant costs to the business and its shareholders over time as well. In the end, we feel the upside demonstrated between traction achieved and market direction more than offsets these risks. Even so, investors would be wise to keep all of these in mind when moving forward.

About: Daniel Jones

Daniel Jones is a graduate of Case Western University with a degree in Economics. He has spent several years as an equity analyst writer for The Motley Fool where he focuses primarily on the Consumer Goods sector but also likes to dive in on interesting topics involving energy, industrials, and macroeconomics, in addition to contributing equity research to publications such as Seeking Alpha.