The Regulation Crowdfunding (Reg CF) Landscape from 2018-2023

While the first Reg CF officially launched in mid-2016, it took a few years for founders, investors, and platforms to adopt the new capital raising exemption.

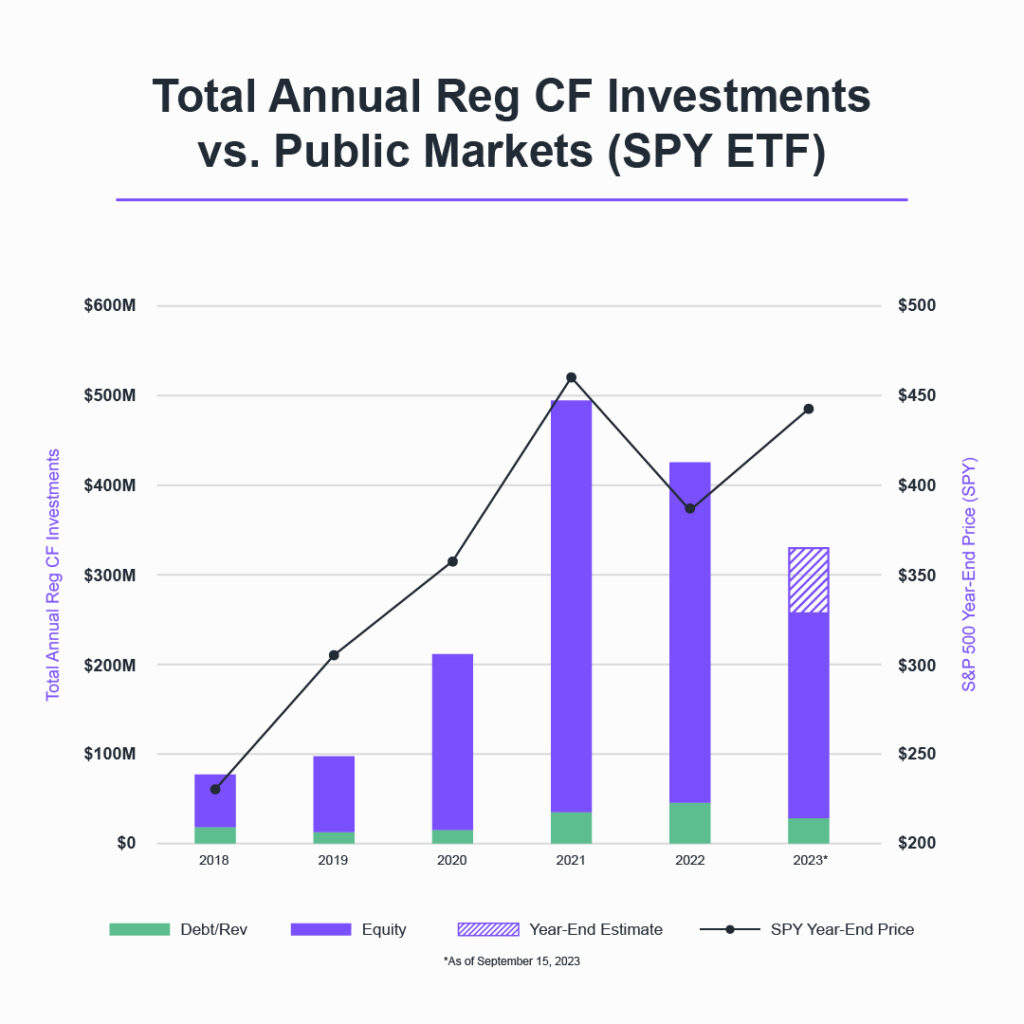

From 2019-2020 and 2020-2021, Reg CF experienced explosive growth in invested capital. Total investments more than doubled each year, moving from $100 million to $210 million in 2020 and then soaring to $496 million in 2021.

Yet, since 2019, only 6-10% of the annual investment volume in Reg CF has been allocated to small businesses raising under debt and revenue-share deals. In contrast, the remaining 90% was equity-based (common and preferred, SAFEs, and Convertible Notes).

Macroeconomic conditions, such as government stimulus and the Fed’s zero-interest rate policy, likely influenced this remarkable growth, as it did the growth in public markets. Additionally, regulatory changes played a part. In May 2021, the SEC’s regulatory changes went into effect, including raising the Reg CF maximum limit from the previous cap of $1.07 million every 12 months to a new limit of $5 million every 12 months.

Since those changes went into effect, KingsCrowd data show that 42 issuers have raised the maximum $5 million under Reg CF.

The Influence of Public Market Performance on Private Market Retail Investor Behavior

Following the peak of the U.S. Stock market (represented by the SPY ETF, which tracks the S&P 500) in late 2021, there has been a gradual decline in investment activity in both Reg CF and Reg A+.

Interestingly, the number of investors has decreased more drastically than investment dollars. A year-by-year analysis of investors for raises that concluded each year reveals a 20% drop in the number of investors in 2022, compared to a 15% decline in invested dollars. This indicates that while fewer investors participated in 2022, those who did were investing larger amounts on average.

| Year | Number of Investors | Annual Change |

| 2020 | 303,000 | – |

| 2021 | 488,000 | +61% |

| 2022 | 389,000 | -20% |

| 2023 | 314,000 (projected) | -19% (projected) |

Despite the positive correlation between the S&P 500 and Reg CF investment volume up to 2022, 2023 has shown a divergence. While public markets have rallied by 17% since the end of 2022, Reg CF investment volume is projected to decrease by nearly 22% from 2022, concluding the year around $331 million.

Potential Drivers of Decreasing Reg CF Investments

Several dynamics might be affecting investors’ willingness to invest in Reg CF deals right now. The repercussions of the Fed’s swift interest rate hikes continue to permeate the economy, and inflation remains more persistent than anticipated. This results in increased costs for retail investors, leaving less capital for riskier ventures.

Those higher interest rates also mean that investors use a higher discount rate when discounting future cash flows to value businesses, which has reduced revenue multiples and valuations in both the public and private markets. If deal valuations haven’t adjusted accordingly, there might be a disconnect between investors and issuers regarding what constitutes a ‘fair’ valuation for the company.

Within the Reg CF industry, we’ve also seen an uptick in recent company failures (check out our exit and failure tracker). The challenges of COVID have been hard on many startups, and many have now recognized that the funding environment of 2020-2021 wasn’t typical for capital raising.

Furthermore, we’ve seen a decrease in the number of active Reg CF raises in 2023. This might indicate fewer viable investment opportunities available for investors.

So what does all this mean for Reg CF and online startup investing?

The Silver Lining

While the data might seem bleak initially, we at KingsCrowd remain optimistic about the industry.

The silver lining? First, those investors who have stuck around are writing larger check sizes on average. This could indicate a shift towards more serious, long-term investors, while speculative investors might be exiting the industry. And that means we’re building and scaling the industry upon a more solid foundation for future growth.

Second, it’s widely recognized that startup failures tend to happen early (e.g. in the first 1-3 years after founding), while the positive exits can take 5-7 years on average, and many unicorns take 10+ years to provide an exit for investors. Thus, we at KingsCrowd aren’t surprised that we’re starting to see more failures of Reg CF startups – especially considering that many of the companies we see weren’t founded until the 2017-2020 timeframe.

Lastly, there’s typically a lag between public and private markets. As observed in 2023, while public markets have rebounded since the year’s beginning, Reg CF investments haven’t followed suit at the same pace. We noticed a similar delay in 2022, where average valuations took longer to correct and private investments didn’t correct as quickly as the public markets.

Thus, we believe it’s a matter of when, not if, the Reg CF investors and issuers come back in full strength.