Editor’s Note: This article was originally published on OPEN’s Substack platform, OPEN Official. We’re grateful to have the opportunity to share this insightful piece with our readers. Enjoy diving into the intricacies of benchmarking in the private VC-backed company landscape.

Navigating the complex landscape of private market investing requires a vigilant pursuit of clarity and objectivity. In most markets, investors rely on indices as tools to facilitate better decision-making, risk management, and investment performance evaluation. Industry benchmarks in particular aid investors’ chances of achieving their financial goals.

Yet, while commonplace in public markets, indices of replicable quality are nascent offerings in private markets. Put differently, the benchmarking industry has yet to fully capture the complexities of private markets, leaving investors to choose from a plethora of patchwork solutions.

OPEN is changing that. We’re launching first-of-their-kind private market indices with the accuracy required to give managers and investors a true measure of late-stage venture.

Why the OPEN UnicornTM Index?

When we first set out to launch a fund replicating an index of the top 50 venture-backed companies, we conducted extensive market research to find the right index to track. However, we quickly realized that existing private market indices have fundamental gaps: leading us to build our own.

We work with world-class partners on our index methodology to provide best practices around our rebalancing and weighting guidelines. Launching an index of the Top 50 venture-backed US companies comes with numerous complexities and nuances, and working with premier partners is critical to ensure that we execute at a high level.

When thinking about the launch of a private market index, particularly in pre-IPO stage companies, we believe there are four key considerations:

- Constituent Selection

- Data Sources

- Weighting & Rebalancing Guidelines

- Index Pricing

We’ll go into each of these considerations to outline how we think about them in the framework of launching an index.

First, A Snapshot of Key Private Market Index Players

OPEN UnicornTM Index

- OPEN Unicorn Index is a market capitalization-weighted index of the top 50 private, US-domiciled, VC-backed companies. The index rebalance will be on a semi-annual basis according to changes in the underlying index. The fund will purchase and sell securities as required in the secondary market. To arrive at a current market price, the below data is compiled and inputted into our pricing model. Data is collected on each Index constituent from several partnered secondaries trading platforms and brokerages:

- Recently executed secondary transactions

- Live bids

- Live asks

- Mutual fund marks

- Public comparables

Refinitiv Venture Capital Research Index

- The Refinitiv Venture Capital Research Index tracks the gross performance of the US venture capital industry through a comprehensive aggregation of venture-funded private company values.

Morningstar Pitchbook Indices

- The Morningstar PitchBook Global Unicorn Indices track privately held, late-stage VC-backed companies globally with post-money valuations of $1 billion or more. Index constituents are derived from PitchBook’s global database of VC-backed companies.

Forge Private Market Index

- The Forge Private Market Index is a benchmark of the actively traded private companies on its private brokerage platform. Forge constructs the index through performance standardization and up-to-date valuations of venture-backed, late-stage companies.

Prime Unicorn Index

- The Prime Unicorn Index is a modified market cap price return index that measures the share price performance of US private companies valued at 1 billion or more. The price changes of component companies are derived from publicly available information associated with company transactions, filings, and other disclosures.

Four Key Considerations of Launching a Private Market Index

Constituent Selection

Market Trends:

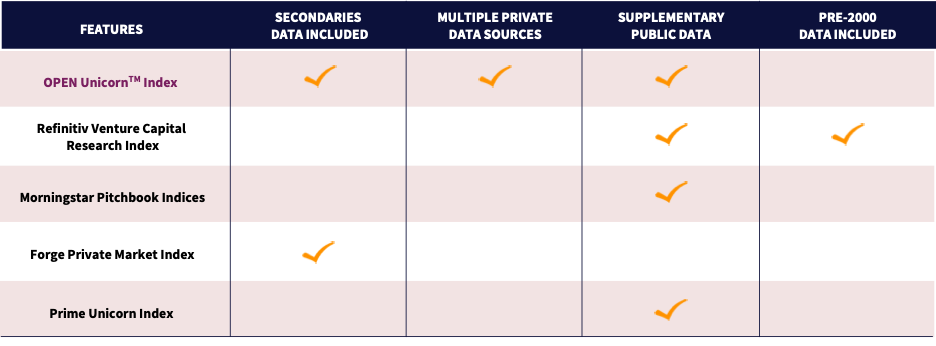

Competing index providers generally structure their venture indices across various dimensions, such as regional incorporation or post-money valuation. Also, the selection criteria employed often include provisions to filter for firms already present in an index provider’s proprietary database. These constraints limit index providers’ depth of constituent coverage and data precision. Given this, providers have yet to release indices that track sub-categories of the venture landscape (growth stage, industry type, product category, etc.).

Our Approach:

Data Sources

Market Trends:

Index providers utilize proprietary assortments of private market information to establish each respective index’s underlying dataset. This information is typically sourced entirely by the index provider and supplemented, to varying degrees, with publicly available information. Data included by these providers can have histories ranging from 2014 to as early as 1996. However, a longer data history increases the risk that the model may not reflect current market trends or dynamics. Although comprehensive, many competitors’ datasets do not include private secondary transactions for constituent firms, which complicates each index provider’s ability to achieve a market clearing price.

Our Approach:

Leveraging its distinct position within the financial sector, OPEN can tap into numerous private market data pipelines, ensuring comprehensive coverage of target constituents and enabling swift customization of index offerings. In addition to secondary data, OPEN sources third-party data, from mutual fund marks and other public sources, imports historical valuations of primary rounds, and captures other publicly disclosed information. OPEN’s proprietary blend of private and public market data allows the firm to publish world-class indices and provide the following services.

Weighting & Rebalancing Guidelines

Market Trends:

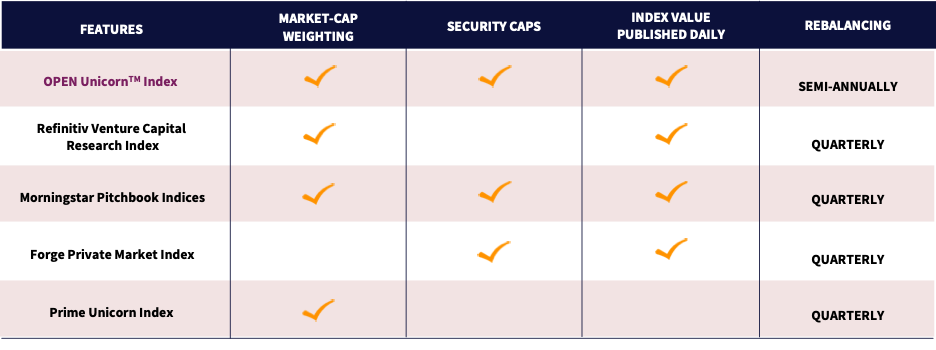

Weighting by market capitalization and quarterly rebalancing are the most prevalent practices in the venture index market and adjacent markets. Few indices maintain additional weighting parameters, like pre-set security caps. Many index providers commonly calculate daily index values for distribution, while others distribute weekly or monthly.

Our Approach:

Given that OPEN utilizes observed secondary pricing data, OPEN’s pricing models maintain significantly improved market accuracy. Both the improved accuracy and prolonged deal cycles in the secondary market allow OPEN to rebalance its indices semi-annually. The Unicorn Index is weighted by market capitalization with a 20% security cap. Index prices are calculated and distributed daily at market close. Collectively, these characteristics accurately capture performance-related price changes and market volatility.

Index Pricing

Market Trends:

Most benchmark providers employ interpolation methods to mark to market. Several leverage data weighting techniques to synthesize various sources of public and private market data. This technique customizes the underlying pricing strategy for individual index constituents and select industries. The incorporation of daily bid/ask in the secondary market is a rare feature in this space.

Our Approach:

Given the nature of a private company, it can be difficult to appropriately determine a market price between funding rounds. OPEN is the only benchmark that employs both data source weighting and interpolation methods while maintaining its targeted constituent coverage. These features in combination with OPEN’s incorporation of the daily secondary bid/ask data underscore OPEN’s pricing preeminence.

Why OPEN?

Driven by our mission to pioneer industry benchmarks within the private market landscape, OPEN is committed to creating equitable and risk-appropriate investment opportunities through transparent, diversification-focused, and cost-effective index-replicating funds. We are poised to mitigate venture capital inefficiencies by collaborating with industry partners and innovating through our private market indices and index-tracking fund strategies. OPEN’s private market indices are appealing to fund managers who are in search of precise and dependable benchmarks reflecting their portfolios. Also, present market conditions prompt a strategic entry into pre-IPO secondaries, capitalizing on the Top 50 US private VC-backed companies’ resilient fundamentals despite an average valuation decline of about 55% in the past year.

Disclaimer:

This information does not purport to be complete and no obligation to update or otherwise revise such information is being assumed. The information set forth herein as of the date hereof. Certain statements, projections, or other estimates herein (including estimates of value, returns or performance) are forward-looking statements and are based upon certain assumptions. This may reference past market data, which is not a reliable indicator of future market behavior and may not represent all trends that may be material to a prospective investor. Such other events that were not taken into account may occur and may significantly affect the analysis. Any assumptions should not be construed to be indicative of the actual events that will occur. In considering the information contained herein, references to other indices, investments, investment vehicles, or any other indications of prior performance of any investment, readers should bear in mind that past market performance is not necessarily indicative of future results, and there can be no assurance that the index or index-replicating vehicle will either achieve comparable results or achieve any of the projections or target returns included in this document. No person may treat this presentation as constituting either an offer to sell, or a solicitation of an offer to buy, any interest in any security. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations. Any reproduction or distribution of this document, in whole or in part, or the disclosure of its contents, without the prior written consent is prohibited.