One of the most exciting things about online equity crowdfunding is its ability to break away from common patterns exhibited by venture capitalists. When the crowd makes the decisions around what companies receive funding, more female and minority entrepreneurs gain visibility. According to TechCrunch, “In 2018, venture capitalists struck 580 deals worth $3 billion — up from just $2.1 billion in 2017 — for all-female teams, or only 2.2% of all U.S. deal activity.” Pitchbook data revealed that in 2020, “companies founded solely by women garnered 2.5% of the total capital invested in venture-backed startups in the US.” Meanwhile, companies with mixed-gender founding teams received 12% of venture capital funding last year. It is promising to see this number rising through the years, even if it is by tenths of a percent.

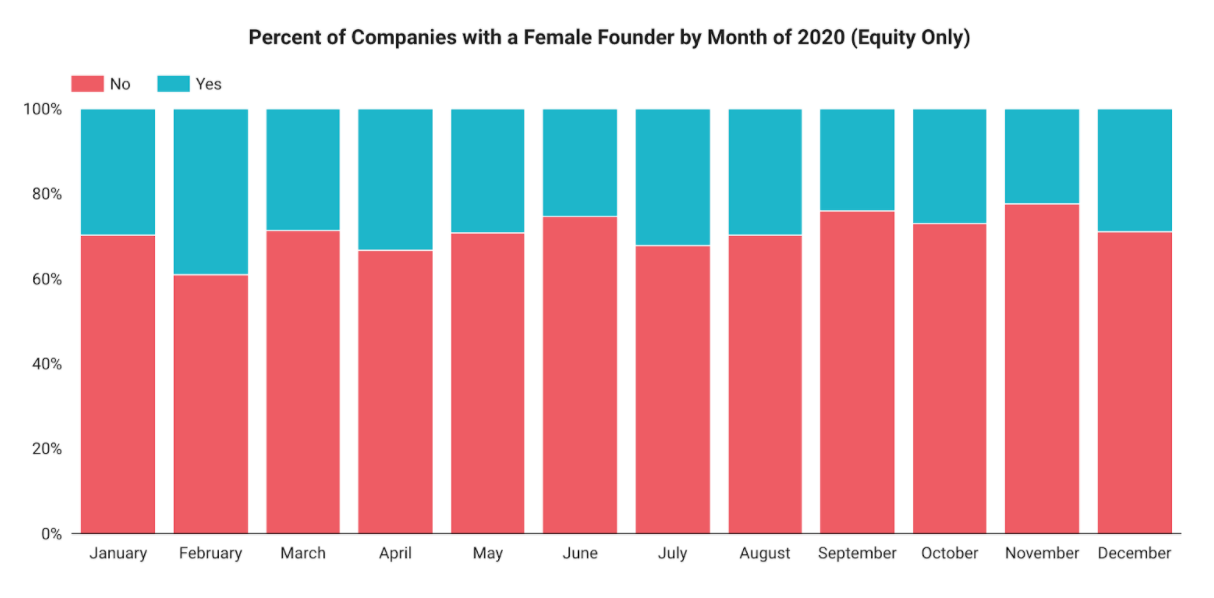

The online private markets — though far from an even split — tell a slightly different story. For our first chart of the week, we broke down the percentage of equity deals that included a female on the founding team by month across 2020. February 2020 saw the greatest representation across equity deals for female founders (blue) at around 40%. At no point throughout 2020 did the percentage of companies with a female founder represented drop below 20% for new deals added.

Granted, representation does not equate to funding. Still, it is promising to see a more even split across founding team representation. This stronger representation likely contributes to the around 10x increase in online private market dollars that go to female founders versus traditional venture capital. Perhaps this is a reason we see more female founders flock to the online private markets. With success stories like Arlan Hamilton of Backstage Capital and Maxeme Tuchman of Caribu, it seems likely that this early trend will continue to strengthen as more female founders turn to equity crowdfunding for the capital they need to build their companies.