At KingsCrowd, one of the first things we determine when rating companies is what stage the startup is currently in. We categorize every company as either early stage or growth stage. Valuation is one of the key metrics we use to separate early stage and growth stage. Generally, early stage companies are expected to have lower valuations than growth stage startups.

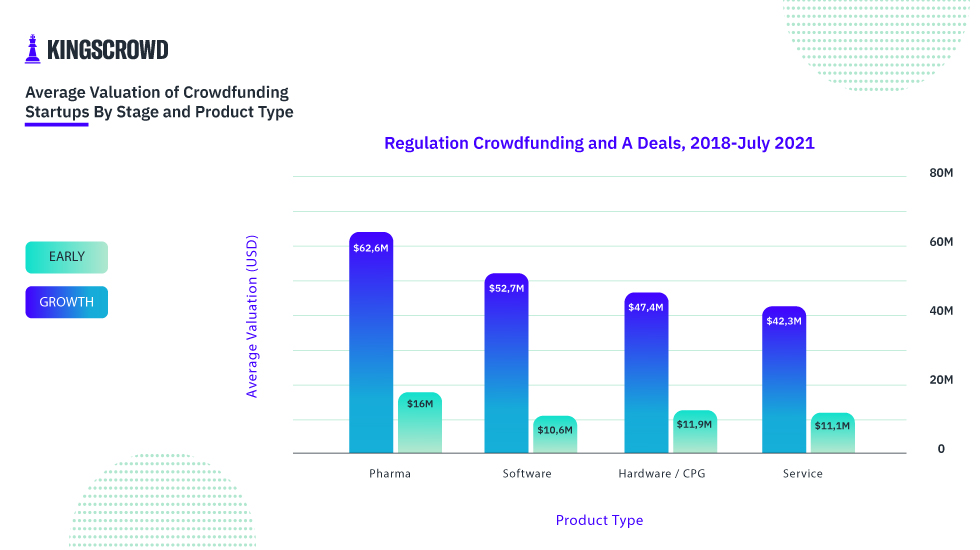

But how big is this gap across different types of products? That’s the question we set out to answer in this chart of the week. We broke down the average valuation by stage across four product types: Pharma, Software, Hardware / CPG, and Service. This data is representative of all Regulation Crowdfunding and Regulation A equity raises that are currently active or have closed between January 2018 and July 2021.

Growth stage pharmaceutical (pharma) companies had the highest valuation overall at $62.6 million on average. This amount is more than $30 million higher than the average valuations of early stage pharma companies. Growth stage pharma startups have likely surpassed regulatory hurdles that early stage pharma companies have yet to overcome, like FDA clearance. Once those regulatory hurdles are addressed, a pharma startup can begin the process of commercializing — increasing the company’s overall value.

Service companies had the lowest average valuation for the growth stage category. At $42.3 million, a gap of more than $20 million separates the average valuations of growth stage pharma and service startups. However, the lowest average valuation in early stage startups was found in software companies with $10.6 million. Early stage software companies could still be developing and testing their solutions, which would drive lower company values.

There is a significant jump in valuations across the board when comparing early stage and growth stage companies in each product type. Growth stage startups have valuations that on average are around $30 to $40 million more than early stage companies. However, the deviation of growth stage valuations across product types is not so drastic — only $20 million separates the highest (pharma) from the lowest (service). The spread is even closer among the early stage companies, with a difference of just $5.4 million. Seeing the stark difference between valuations of early stage and growth stage startups shows the importance of separating these companies when assessing investment potential.

Note: all data used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.