One of the most appealing factors of the online private markets is the low monetary barrier to entry. For years, only venture capitalists and angel investors could participate in private, early-stage raises. Now many of these formerly exclusive opportunities are available for everyday investors, often for as little as $100. For perspective, a single share in Alphabet Inc. (GOOGL) hovers around $2,500.

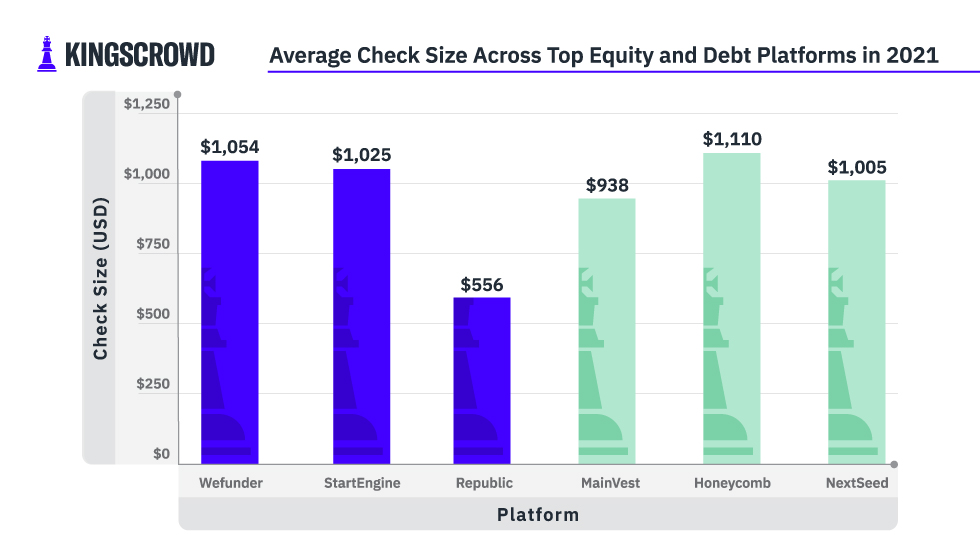

This week we broke down the average investor check sizes across the top three equity and debt platforms. Wefunder, StartEngine, and Republic saw the largest number of equity investments over 2021. Equity deals involve purchasing and owning shares of a company currently, or in the future (like with SAFEs). MainVest, Honeycomb, and NextSeed primarily host debt and revenue share deals. Revenue share deals are debt security offerings that provide investors with recurring payments based on the business’s future financial performance. Debt deals pay investors back on their investment, typically with interest.

Debt and revenue share deals tend to be the preferred method of funding for cafes, restaurants, bars, and other small or family-owned businesses. It is common for these deals to have lower round maximums than equity deals raising on Wefunder, Republic, or StartEngine.

Interestingly, the average check sizes did not significantly differ across equity and debt platforms. In fact, across the three debt platforms, the average check size was $1,017, compared to an average check size of $878 across the top three equity platforms. Across both debt and equity deals, Republic had the lowest average check size for 2021 at $556. Debt-focused Honeycomb had the highest across the board at $1,110.

Higher average check sizes tied to debt deals may be due in part to investor loyalty. If your favorite hometown restaurant or bar raises via the online private markets, you may be more eager to invest larger amounts as opposed to a less personal investment in an energy or software company that is raising $5 million. After all, many early stage investors want to appreciate the impact that their commitments are making. This impact may be more tangible when applied to your local coffee shop.

The ability to invest with as little as $100 also allows for diversification. As an investor in early stage companies, you could allocate $500 to the online private markets and have a strong and diverse portfolio of as many as five companies. Investors looking to build a diversified startup portfolio may choose to spread their capital across many companies, whereas investors looking to support a local business may make fewer investments overall. In either case, the accessibility of the online private market provides ample investing opportunities for all individuals.

Note: All data used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.