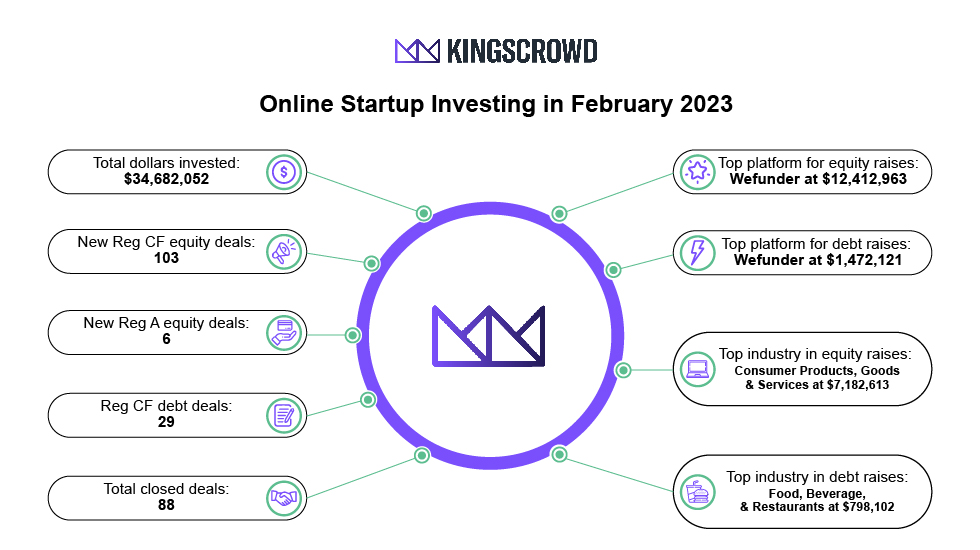

In February 2023, a total of $34.7 million was invested across Regulation Crowdfunding (Reg CF) and Regulation A (Reg A) raises. This is a rise of 23.7% from January 2023, which is a positive indication that startup investors are beginning to invest more into the crowdfunding space to start the year. However, the amount invested is still down 28.6% year-over-year from February 2022. This indicates that there is still a ways to go before the crowdfunding market is fully recovered and operating at full capacity.

Wefunder had a big month, beating all other platforms for both equity and debt raises. Wefunder raised $12.4 million in equity funding and $1.5 million in debt funding for startups on its platform. Wefunder tends to dominate the crowdfunding market in terms of total number of raises, so it’s not all that surprising that it leads the way in terms of total dollars invested. The more impressive feat is that Wefunder leads the way in debt raises. There are many platforms, like Honeycomb, that specialize in debt and revenue share raises. But Wefunder has established its brand in a growing field of startup portals, and investors clearly turn to it for the best raises for both debt and equity.

The top industry for equity raises was consumer products, goods, and services, raising an aggregate of $7.2 million. These tend to be products and services that investors easily resonate with and perhaps use themselves, so it’s not surprising that this industry led the way.

For debt raises, food, beverage, and restaurants led the way with $798,102 in aggregate funding. Restaurants tend to be the most common type of debt raise. These raises are attractive to investors as they give investors predictable investment returns and a safer position on the capitalization table (since debt holders get paid out first if a company goes under).

February was a positive month for the crowdfunding market. Hopefully we will continue to see growth in dollars invested in the coming months as the economy recovers and inflation subsides.

Note: All data on online startup investing used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the US crowdfunding market.

“Platform” is defined here as the SEC-registered intermediary (broker-dealer or funding portal), or if none, the primary non-broker or non-funding portal platform conducting the offering.