KingsCrowd started in 2018 with a mission. We want to enable everyone to make informed decisions in startup investing. We started out by aggregating and providing analytics on startups raising capital across 50+ online equity platforms.

But we wanted to do more than just that. We want startup investors to be able make data-driven decisions. That’s why we’ve been working for months to bring our ratings and analytics platform to life. And now we’re finally there.

Meet Merlin

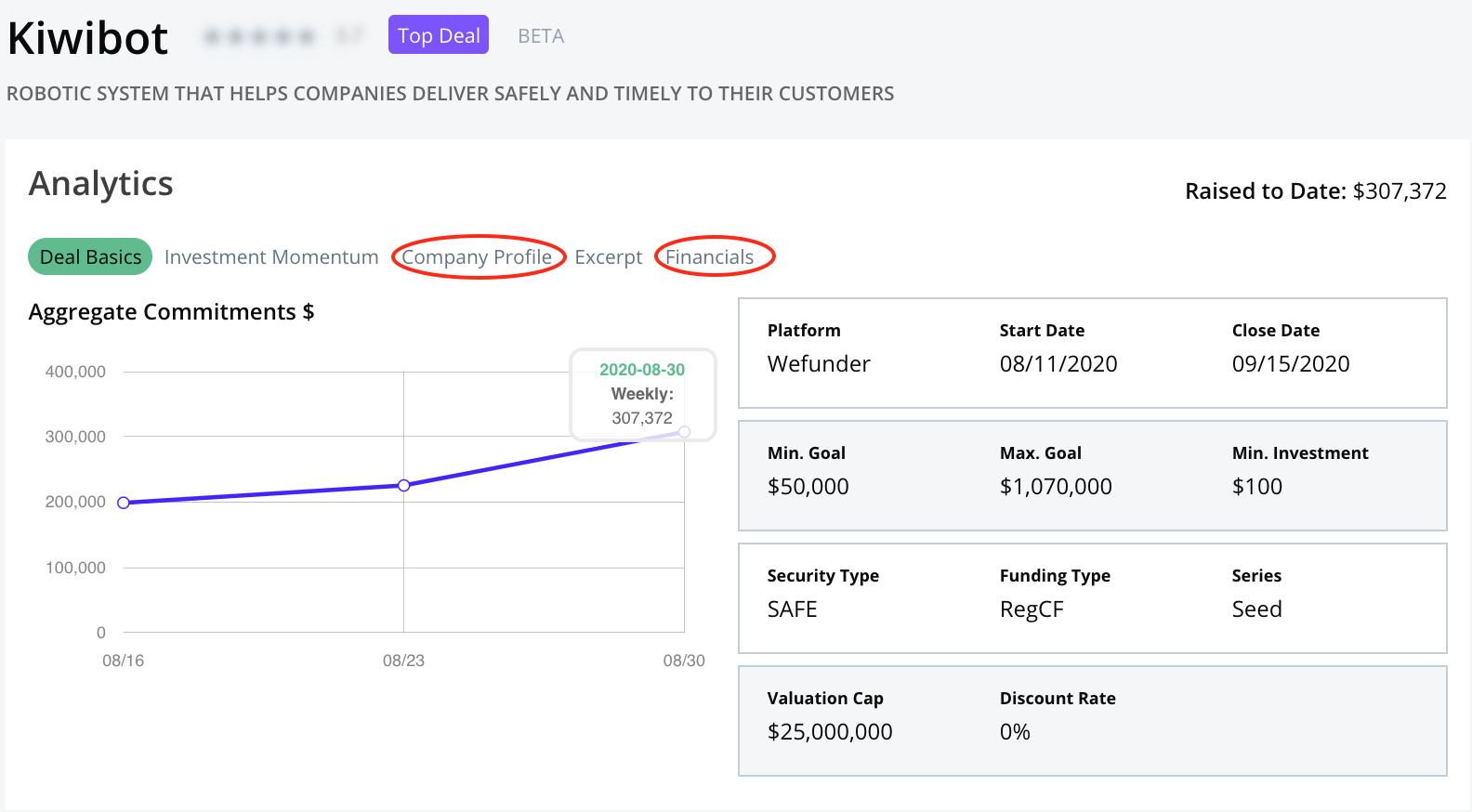

On August 27th, we released the beta version of our platform, Merlin. At first glance, not much seemed to change. That’s because Merlin is central to what we do at KingsCrowd. We seamlessly integrated it into the model and website we had already built. The company analytics pages got a slight makeover to make them even more convenient and comprehensive. All the same analytics information we’ve been providing for two years is still there — but we added more as well. Now you can view the company’s financial data (taken from their SEC Edgar filing) as well find links to their websites and images of their logos (when available).

But Merlin is so much more. Beneath the Analytics section of a company, you’ll find Ratings. We rate every company based on five key metrics — Price, Market, Team, Differentiators, and Performance.

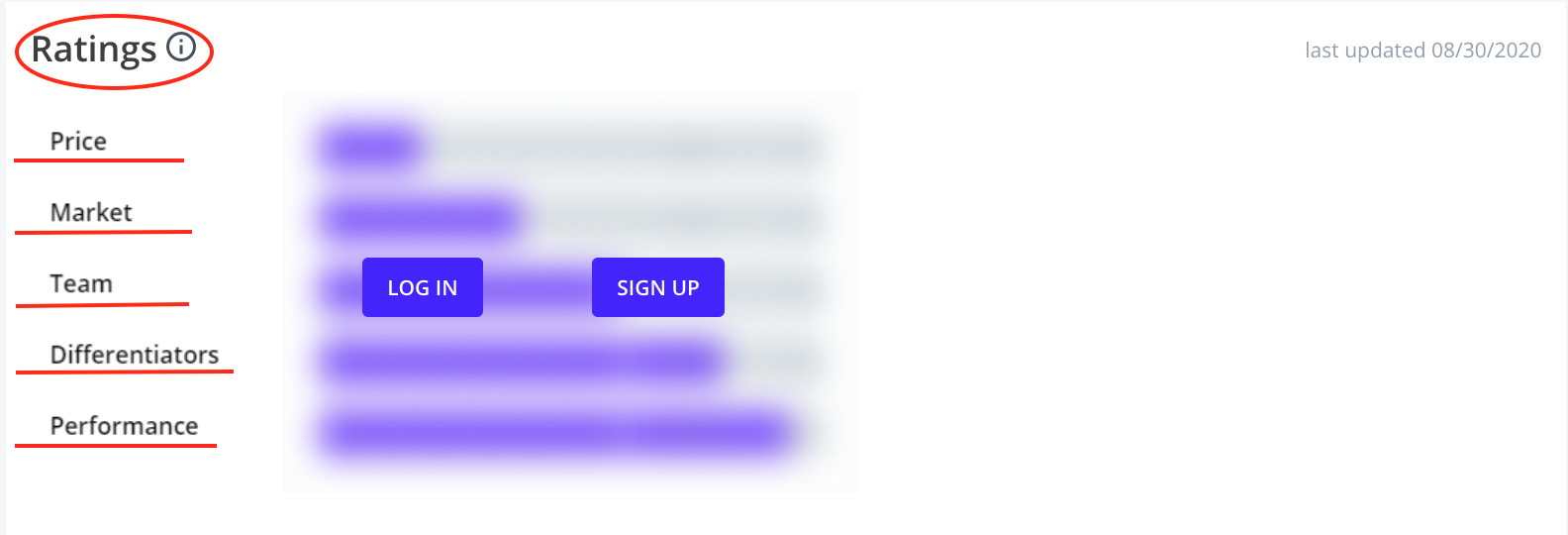

We then take a weighted average of those factors to reach a 1-to-5 score for a startup (that’s the score at the top of the page, right after the company name). You can read more about our ratings methodology here. For the beta version of Merlin, only Crowd and Pro members that have opted-in for beta access can see company Ratings. Free members (and anyone not logged in) will see a blurred box like in the image above.

Currently, we only have ratings for startups that are conducting Regulation CF raises. We are working hard to add Regulation A+ and Regulation D (as well as debt and revenue share) deals in the future. Additionally, it takes time to gather all the necessary data for our ratings. If you find a startup conducting a Reg CF raise that doesn’t have ratings yet, give it a little bit of time. We promise to provide you with data-driven ratings as quickly as we can.

Some of you may be wondering about our previous Staff Pick ratings — Top Deals, Deals to Watch, and Underweight Deals. Those haven’t gone away in Merlin! Startups that were selected as Staff Picks will have an additional Research section beneath their Ratings box where you can read our detailed analyses. As before, this in-depth research is only available to Crowd (for Regulation CF deals) and Pro (for Regulation A+ deals) members. We’ve also started providing research on a new category of Staff Picks: Neutral Deals. These are startups where we think the strengths and weaknesses are pretty evenly balanced — making the investment a neutral opportunity. You can always tell if a company has been selected as a Staff Pick (and at what level) when you first arrive on its page. Right at the top — after the company name and its overall rating — a tag will show up if the startup has been given a Staff Pick rating.

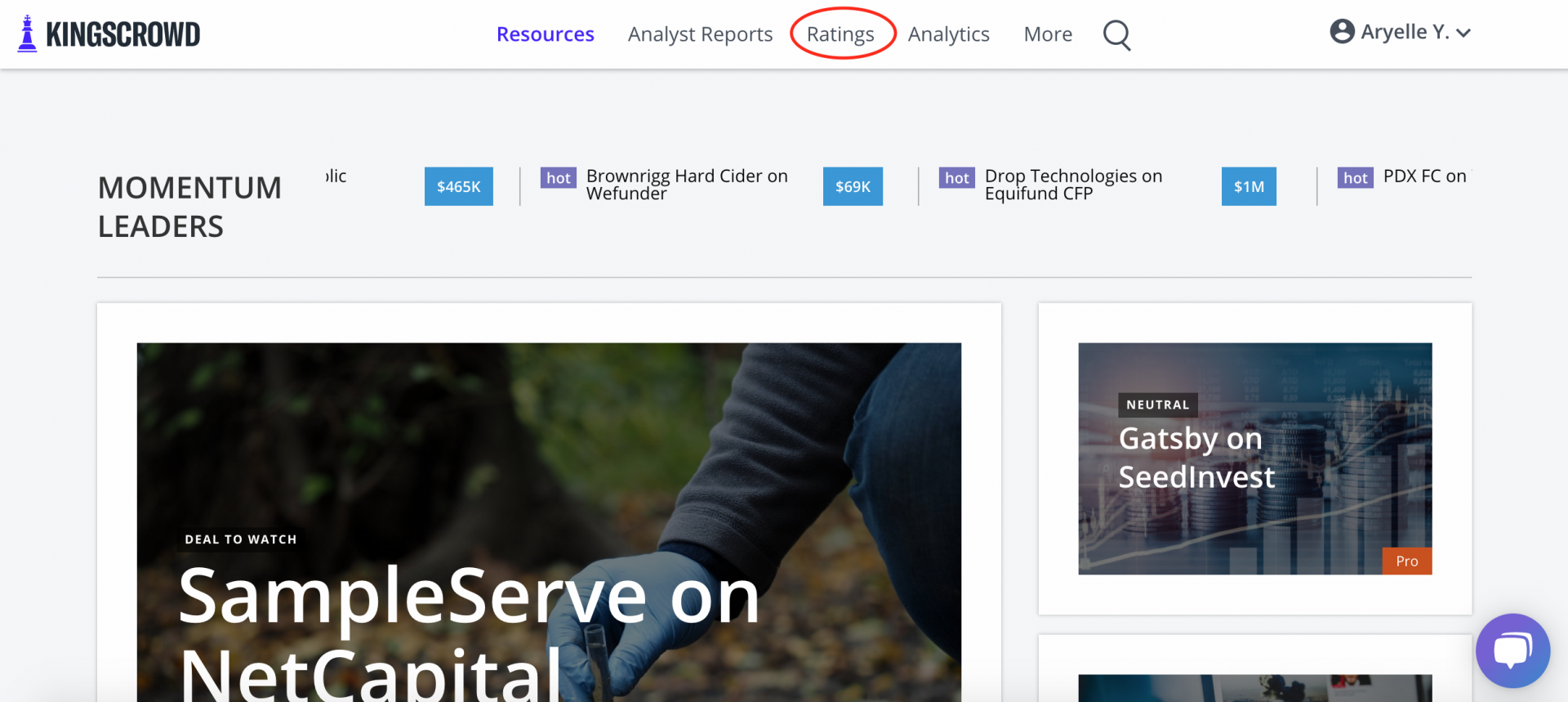

Sortable Ratings Table

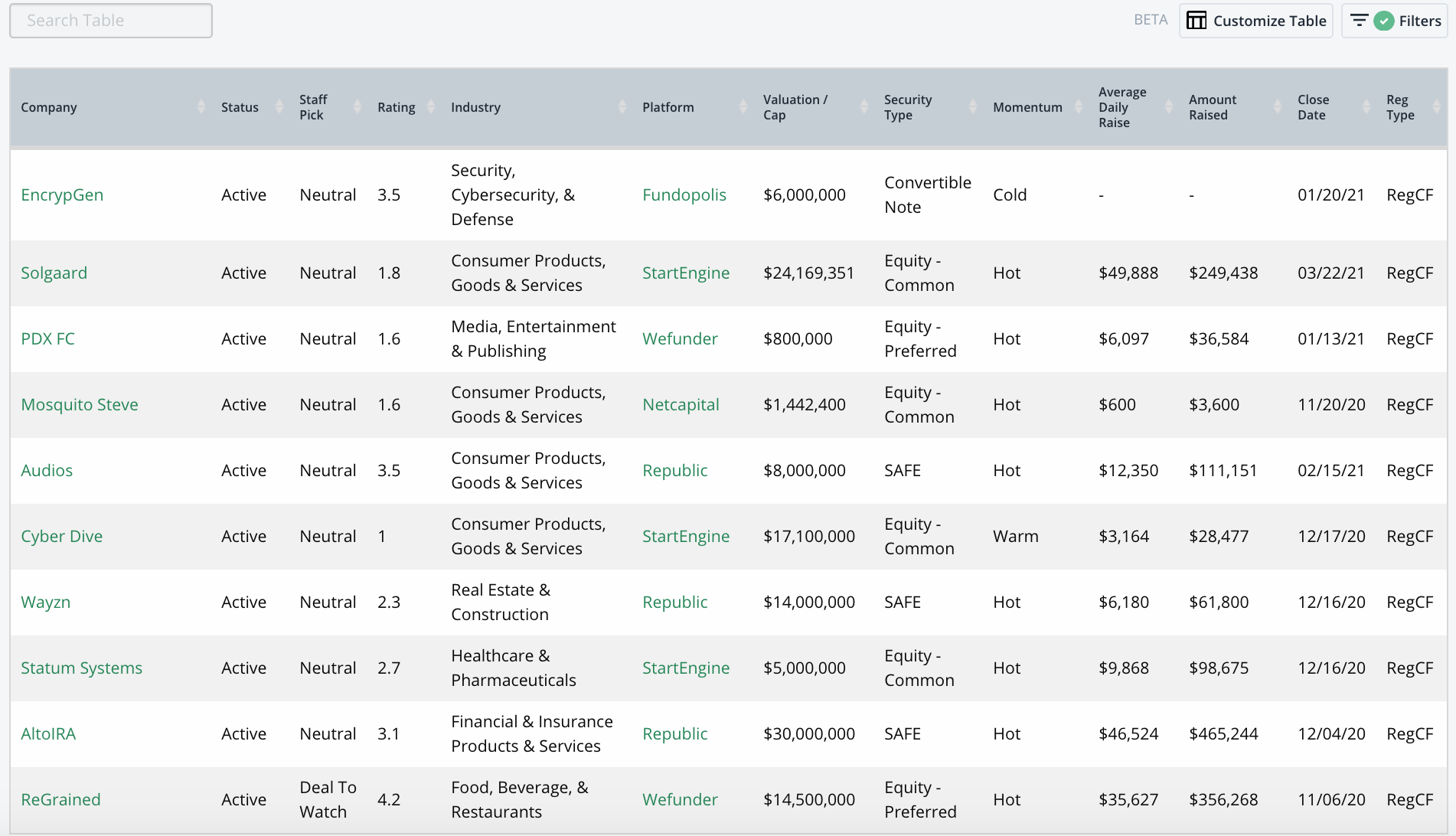

Merlin’s sortable ratings table gives you complete access to the 2,000+ startups in the KingsCrowd database. It’s accessible through the “Ratings” tab.

Once there, you’ll see a table listing startup raises and their various details — from industry to platform to total amount raised. By using the filters and customization options, you can use this table to hone in on the exact kind of startup you want to find.

The “Customize Table” button lets you control the columns of the tables — the various raise details. Not interested in the Security Type? Just deselect it from the dropdown menu. Want to know how many investors have put money into startups? Select “Investors” from the dropdown menu.

The filters are where you can really refine the startups you’re viewing. Once you click on “Filters” in the righthand corner, you’ll be able to limit the results for each column in the table.

Say you only want to see raises that are currently active. Just click on “Status” and de-select “Funded” and “Not Funded” in the dropdown menu (see picture below). The table will immediately update to only show ongoing raises.

Do you only want to see active raises from Republic? Just set your Status and Platform filters accordingly. Interested in fintech startups? Choose only “Financial & Insurance Products & Services” under Industry and you’re good to go.

We’re also planning for added functionality in this table in the future. We want to add more filters (such as female founder, minority founder, social impact, etc.) as well as the ability to save settings/searches. Let us know if you think there’s a characteristic or feature we should add!

Detailed Ratings Breakdown

Our detailed rating breakdowns enable you to drill deeper into the data that we collect on every startup.

Each of the five metrics has unique information that we collect and evaluate in order to reach a numerical rating. Our detailed breakdowns allow you to see how a company’s characteristics, team, business model, and more compare to the thousands of other startups in our database.

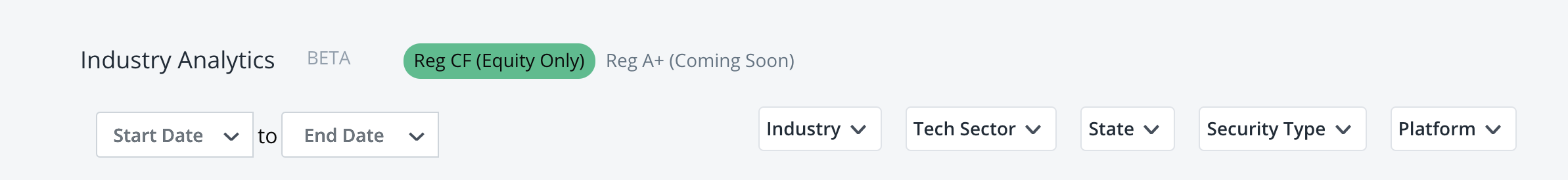

Industry Analytics

Our industry analytics give you the ability to observe trends and patterns in the online crowdfunding market at a broad level. We provide detailed graphs and charts that show valuation amounts over time, total amounts raised over time, number of new companies over time as well as amount raised by security type and per platform. Additionally, all this data can be manipulated according to various fields, such as industry, date range, and state.

How Merlin will Grow

Providing data-driven ratings for startups in the crowdfunding ecosystem is just the beginning of Merlin. We have a four phase plan for fully rolling out Merlin Beta. Phase One was the unified company pages — bringing together the analytics, data-driven ratings, and (when available) analyst research into one convenient and intuitive page. Here’s what else we have planned:

- Phase Two: Sortable Ratings Table. In this stage, you will be able to sort through all the startups in the KingsCrowd database by feature (industry, platform, date opened, female founders, and more) and by their ratings. Phase 2 went live on September 24, 2020.

- Phase Three: Detailed Ratings Breakdown. We’ll provide a detailed breakdown of our data-driven ratings for each company, giving you deeper insight into a startup’s potential return on investment. Phase 3 went live on October 22, 2020.

- Phase Four: Industry Insights. Finally, in Phase Four we’ll give you industry insights so you can fully understand the market in which a startup operates. Phase 4 went live on December 10, 2020.

We hope to complete all four phases during this fall. Because Merlin is still in beta right now, there will probably be some bugs. We ask for your patience and feedback as we continue to build Merlin into the best ratings and analytics platform it can be. Please let us know of any bugs you find by reaching out to support@kingscrowd.com. We also want to give a big shout out to our Beta users! You’re helping us make Merlin into a top-notch product, and we couldn’t do it without you.