Generative artificial intelligence (AI) has been the hottest topic of 2023 so far. In the 2023 Y Combinator winter batch, there are 59 generative AI startups — one-fifth of the total batch.

We are now quite familiar with the roles that generative AI plays in several areas, including content creation, creative design, data augmentation, and more. But how does generative AI fare in the venture investing space?

To find out, we did some experiments using ChatGPT and Bard (Google’s AI chat service) focusing on the two main aspects of venture investing: sourcing and evaluation.

Sourcing

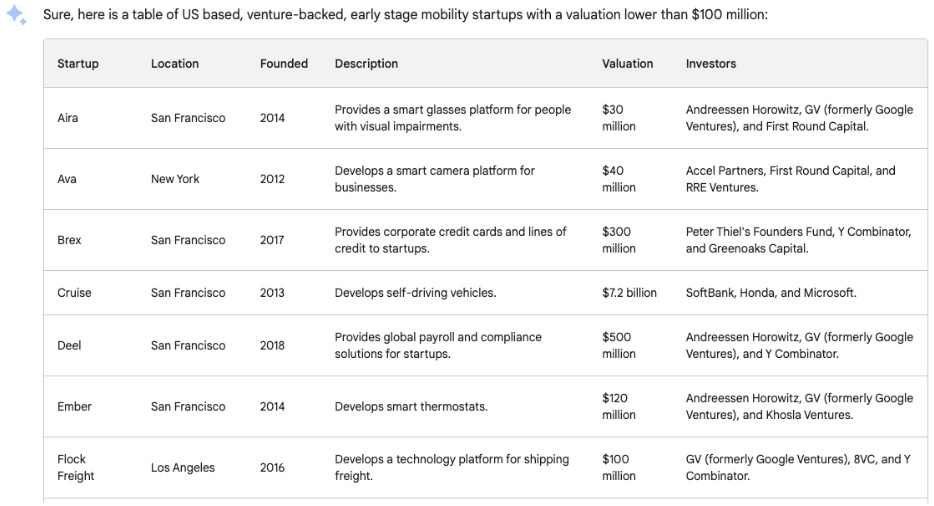

Deal sourcing poses a common problem in the venture community. Investors often have a difficult time finding the exact types of companies that fit into their investment theses. And to test the capability and the usability of generative AI, we need to ask specific questions. A typical investment thesis could have criteria such as industry, stage, geography, and funding type. So we asked ChatGPT and Bard: Can you identify U.S.-based, venture-backed, early stage mobility startups with valuations lower than $100 million?

Both ChatGPT and Bard produced a list of startups. Most of the startups on ChatGPT’s list matched our criteria, with the exception of one company that has a valuation greater than $100 million. But Bard’s list did not fit the criteria well. Cruise can hardly be considered an early stage company. Brex and a few other companies are not mobility startups. And several companies in the list have valuations well over $100 million.

We went one step further and added “revenue multiple less than 10x” to our list of criteria. Unsurprisingly, neither ChatGPT nor Bard could give a comprehensive answer due to revenue multiple data being private.

The verdict: So can generative AI help investors source deals? Yes, to a certain extent. ChatGPT performed well in identifying companies by accurately narrowing them down using publicly available data. ChatGPT’s result is already more comprehensive than one would get searching on Google or manually sourcing, assuming the data is up to date. However, this process still requires human validation. And in the case of Bard, the result was not quite usable.

Evaluation

When evaluating startups’ competitors, investors could potentially use generative AI. Once we identified a startup from the sourcing list, such as Gridwise, we began analyzing its competitors in the rideshare software solutions space. So we asked ChatGPT and Bard: What are Gridwise’s competitors?

Both ChatGPT and Bard produced a list of competitors. ChatGPT’s list of competitors mostly had the target customers of rideshare drivers. Bard’s results widened the spectrum of customers to include self-employed individuals and contractors. Both lists make sense, as the scope of competition could vary for different investors.

We also input prompts such as “How is Gridwise compared to Rydar?” in both language models. The results are fairly comprehensive, providing key differences in terms of features, pricing, and user interfaces. Therefore, it is safe to say generative AI could potentially help investors identify and evaluate competitors.

Another potential use case of generative AI when evaluating companies is building financial models. For this experiment, we used Apple’s 2022 10-K, which contains 80 pages of company information. (Many private companies do not publicly share their financial statements, so we had to use a public company as an example here.) The goal of this experiment was to see if ChatGPT or Bard could successfully extract the income statement and also build a projection for 2023.

Both ChatGPT and Bard produced income statements. However, after validation, the numbers extracted from the 10-K are not exactly correct. The results for fiscal year 2022 income statements are also different between the two language models. For example, ChatGPT showed a net income of $82.1 billion and Bard showed a net income of $125.8 billion. The actual net income reported in Apple’s 10-K is $99.8 billion. I even tried to point out the exact page that the income statement was on, but both ChatGPT and Bard failed to provide accurate numbers.

As for 2023 projections, ChatGPT struggled to make assumptions about growth rates and margins. After we added the prompt of “assuming same growth rates and margins,” ChatGPT produced the projection. Bard successfully made assumptions based on Apple’s historical performance, competitive landscape, company road map, management’s guidance, and the current economic environment. We asked what the assumptions were in a follow-up question. Although the base numbers were wrong, it was still fairly impressive that Bard gave a comprehensive result with forecast assumptions.

The verdict: Both ChatGPT and Bard can help investors with the evaluation process of venture investing to a degree. But the quality of the responses from these language models may vary. So investors should still do their due diligence when evaluating startups.

Limitations

Through this experiment, we learned that generative AI still produces a lot of misinformation. Investors may have to validate the results, as some of the responses could be factually incorrect. In addition, the insights that generative AI can offer could be limited. The two language models sometimes struggled when making analyses and predictions, which are important in venture investing.

Another limitation of generative AI in venture investing is that data could be outdated. The current knowledge cutoff date for ChatGPT is September 2021. Venture investing is an incredibly time-sensitive process, so not having access to up-to-date information is a major problem.

A Work in Progress

So can generative AI help with venture investing? The short answer is that it’s likely, but its efficacy could be improved. Both ChatGPT and Bard could help research the industry and make basic comparisons. When evaluating startups, generative AI could potentially save investors time by extracting critical information — if it can improve the accuracy of the responses.

Generative AI is still in its infancy and still has many limitations, but future language models can only get better for years to come.