“Speed, simplicity and cost. Indeed, a startup could close a convertible note round in a day or two by merely issuing a 2-3 page promissory note, which could cost as little as $1,500-$2,000 in legal fees,” startup lawyer Scott Walker wrote in this article in 2012. That’s how convertible notes were perceived 10 years ago, a time that was considered the peak of seed financing’s golden age.

Just one year later, Y Combinator (YC) introduced a faster, simpler, and totally free seed financing agreement: the SAFE, or the simple agreement for future equity. In my opinion, that was the beginning of the end for convertible notes.

At their peak, convertible notes were compared to priced rounds of financing, such as Series Seed and Series A preferred stock rounds. Priced rounds come with a long list of terms to be negotiated, especially the startup’s valuation. Other terms include liquidation preferences, preferred dividends, and approval rights over certain company decisions. As you may have guessed, priced rounds take much more time and can cost 10 times the legal fees of convertible notes.

But convertible notes have their own issues too. First of all, a convertible note is debt that comes with an interest rate and a maturity date, and it has to be paid back in equity or in cash at some point. The conversion of that debt to equity can be triggered by not only a subsequent priced round but also by any triggers founders and investors negotiate, like a qualifying event or a minimum raised amount. Lastly, when a company issues multiple convertible notes at different times, both investors and founders have to wait until all notes have been converted to get a clear idea on their ownership percentage and dilution. Offering many convertible notes can complicate a startup’s capitalization table — which benefits no one.

SAFEs were introduced to provide an even better way for startups to raise capital through seed rounds. And they are more founder-friendly than convertible notes. Founders can download a standard SAFE from YC’s website, making it easy to get started. SAFES also costs little-to-nothing in legal fees, and there is no liability for founders to pay back the investment amount if the company fails. And with the latest innovation by YC, the post-money SAFE, it’s even easier to track all the potential changes to the company’s capitalization table upfront in case there are multiple SAFEs offered at different times.

In recent years, more founders shifted to the online private market to raise seed rounds. Utilizing online startup investing enables founders to access more investors, build a community of owner-customers, and — most importantly — dictate their own funding terms. This shift has enabled founders to break free of investors’ influence and choose SAFEs more than convertible notes.

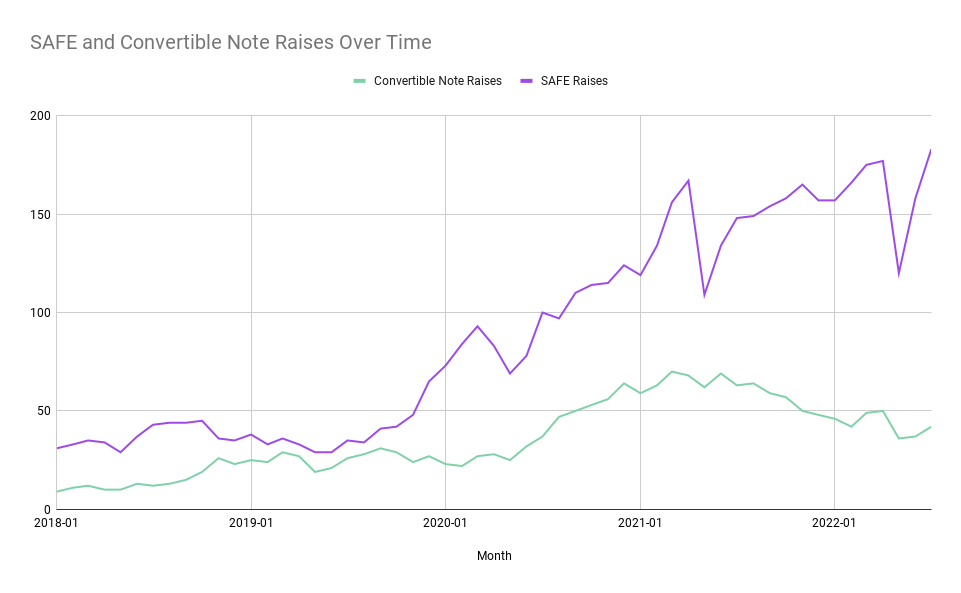

At KingsCrowd, we’ve been collecting data on all Regulation Crowdfunding raises since 2018. And we’ve seen firsthand the rise and fall of convertible notes in the online private market alongside the growing adoption of SAFEs.

Convertible notes aren’t completely dead yet. But I believe that fewer and fewer founders will raise capital on convertible notes, especially in online raises. Convertible notes might still be needed as bridge rounds between growth stage priced rounds — but I don’t see them as a main seed stage financing tool anymore.

It’s worth mentioning that the majority of founders choose to raise capital in common stock priced rounds when raising from the online private markets. Common stock rounds exceed preferred stock rounds, SAFEs, and convertible notes combined in the online private market. But that’s a topic for another blog post.