Impact investing is an investment strategy that targets both financial returns and positive impact by solving or mitigating social or environmental issues. Crowdfunding platforms launch an average of 20 new impact equity deals a month, giving online investors plenty of choices. Some industries dominate in representing impact deals, and the amounts invested in deals show that online impact investors have a clear preference.

I’ve been following the online impact startup investing market closely since January 2022. And over time, I have noticed that startups trying to resolve environmental issues are more common than startups trying to solve social injustices. Our data proves this observation.

Energy startups dominate the offerings, as 23.1% of impact deals are in this industry. Startups offering energy storage, solar energy, and wind energy solutions are the most common. Consumer products are the second biggest category of impact deals. Impactful startups in this industry often offer goods made with recycled or sustainable materials.

The transportation and food sectors each represent around 10% of online impact raises. Many startups with e-mobility solutions and organic products raise on equity crowdfunding platforms.

The top impact startup industries show that raises with business-to-consumer solutions dominate the deal offerings (consumer goods, packaged food, e-mobility, and consumer energy solutions). It makes sense. After all, crowdfunding is both a way to raise money and a marketing strategy for many startups to turn clients into investors and investors into clients. It’s easier to find enthusiastic ambassadors for products and services that everyday people can use.

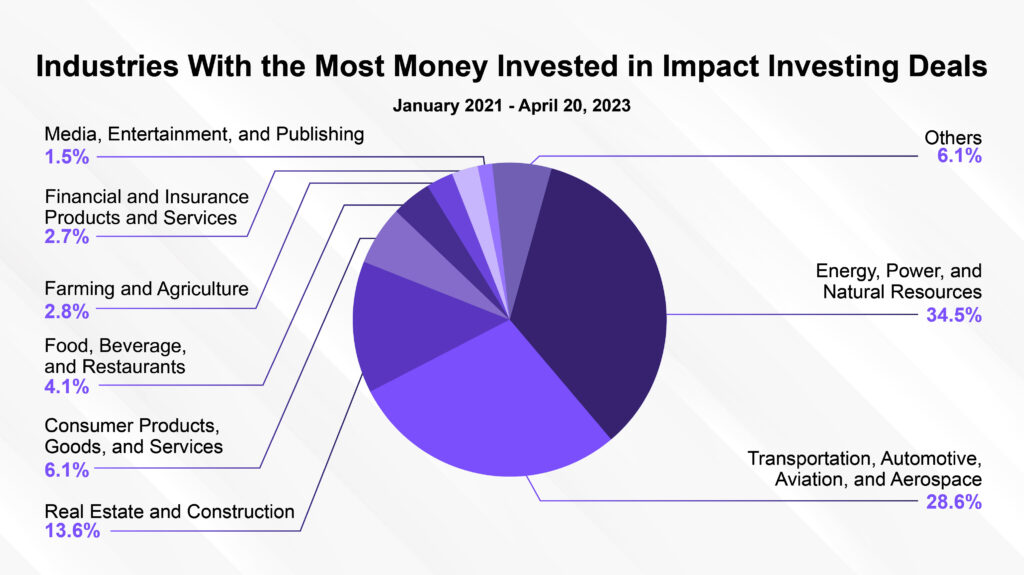

So which impact investing deals actually attract the most money?

Interestingly, online impact investors have a strong preference for energy and transportation startups, which attracted a total of 63.1% of the funds invested. I understand investors’ infatuation with these industries. In order to mitigate climate change, global transportation and energy infrastructures must completely transition from fossil fuels to renewable energy. This transition requires yearly investments ranging from $1.5 trillion to $9.2 trillion. At the same time, energy investments are enticing for investors. Between 2015 and 2020, publicly traded renewable energy companies yielded a 43.2% average annual return while fossil fuel companies yielded only an 8.9% average annual return.

Investors also put a massive amount of money into the real estate industry. Impact investing deals in this industry have both an environmental and social impact. Some startups are using sustainable materials, others are growing affordable housing companies, and some are doing both.

Since January 2021, 484 impact deals have opened online and received more than $400 million from impact investors. I’m excited by how dynamic the market is. And I can’t wait to see crowdfunded impact startups bring investors exits in a few years.

Note: All data used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.