One of the best parts of online startup investing is its accessibility. That accessibility comes both in terms of geography and money. In traditional angel investing, investors needed to be in the room to be part of deals. They were (and sometimes still are) restricted to investing in startups that are local to their area. Online startup investing completely destroys this restriction. Startups in Chicago can find investors in New Mexico – and vice versa.

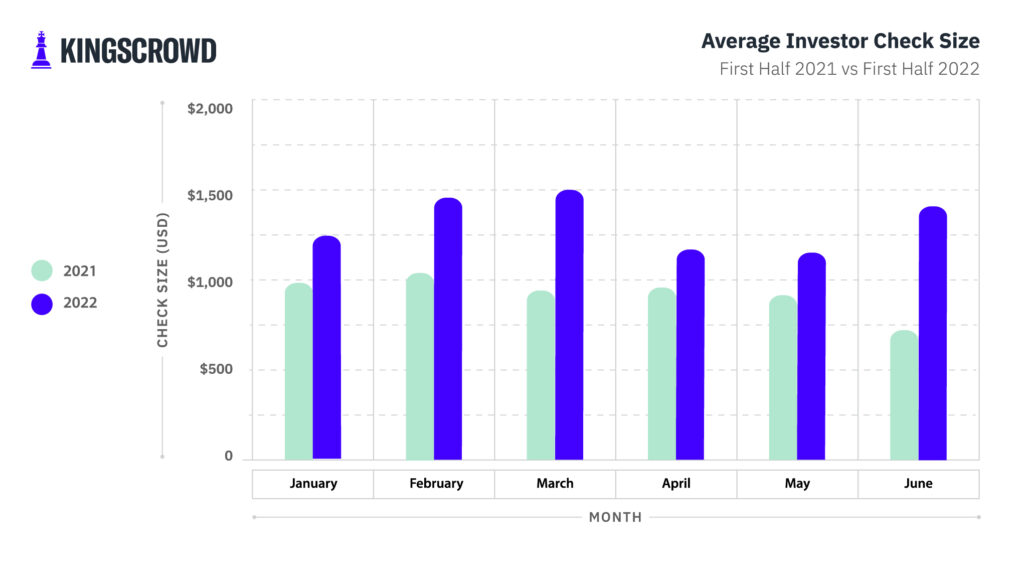

But online accessibility goes beyond location. It’s also a matter of money. And online startup investing deals often have investment minimums that are far more reasonable for everyday investors than the tens of thousands (or more) often expected in venture capital (VC). But while we regularly see deals with minimums as low as $100, the average checks written by investors tends to be higher than that. And looking at how average check sizes have changed can reveal clues about investor morale and their reactions to market developments. In this Chart of the Week, we broke down the average check size per investment on a monthly basis for the first half of 2021 and the first half of 2022. It is important to note that a limited number of platforms share the total number of investments made in any given raise. However, we believe the following data and analysis is still representative of online startup investing as a broad market.

We’re seeing higher average checks being written in 2022 than we did in the first half of last year. Across all six months, checks are up more than 40% this year. In fact, checks in June 2022 were nearly double the average size in June 2021. However, there’s another interesting trend that we found in this data – the number of investments being made is down. We saw nearly 60,000 investments made from January to June 2021. That number is down by 26.5% this year.

So what could be driving the change in check sizes? An initial possibility is changes made in legal regulations for online startup investing. In March 2021, the maximum that a startup could raise under Regulation Crowdfunding went up from $1.07 million to $5 million. Early on, many wondered if this update would affect investor behavior. But that doesn’t seem to be the case. From March 2021 to April 2021, average investor check sizes went up just $23, from $943.47 to $966.62.

Increasing the amount companies could raise benefited founders more than investors, so that could be why investors’ check sizes didn’t change much. Another explanation could be that updating the regulation brought in higher-quality investment opportunities. While this might encourage people to invest in more deals, it doesn’t necessarily mean they wrote larger checks.

Rather than shifts within crowdfunding regulations, shifts in the general economy appeared to inversely correlate with average investments in online startup investing. In the first half of 2022, the stock market suffered heavy losses as inflation drastically rose. In an attempt to curb inflation, the Fed has also recently made some of the most aggressive interest rate hikes since the mid ‘90s.

Although the public markets are flailing, online startup investors seem to have faith in the private markets. Check sizes in 2022 have been consistently higher than those of 2021. Perhaps a bearish public market has prompted investors to allocate money into private deals and expand portfolios to include startup investments. However, that same bearish market – and rising inflation — might also be the driving factor behind the decline in overall investments we’ve seen. Some investors may be drawing back from all markets – not just stocks.

On July 19th, the S&P 500 had its best day in almost a month. Still, the possibility of a recession is not out of the question. Even the crypto markets — a long-hailed alternative to the public markets — are facing a bear run and proving to be correlated to investor confidence in the public markets. One of the best ways to ride out hard economic times is to have a diversified portfolio. Online startup investments are now a strong complement to any portfolio and should not be discounted even when the public markets crash.

Want to know how more about how online startup investing has changed in the last year? Check our past Chart of the Week articles on total dollars invested, startup valuations, and number of deals to learn more.

Note: All data on online startup investing used for the Chart of the Week comes from the KingsCrowd database and represents a snapshot of the crowdfunding market.